Crypto Tax Calculation How To Calculate Crypto Taxes

This article is part of our tax guide. Get help with cryptocurrency tax filing.

The cryptocurrency taxes you’ll owe are calculated based on the capital gains or losses from your digital asset holdings of coins like bitcoin. You are taxed on value your crypto gains between when you acquire it and when you sell or exchange it. The accounting is the same as stock trades or the purchase and sale of a house.

How crypto tax calculation works

To accurately compute your tax liability, you will need to track your tax lots. Tax lots entail the cost basis (the amount you originally paid for the crypto), the time held, and the price at which you traded away or sold the tallerembajador.com.mxcurrency tax software handles this automatically, using your investment and trading history.

You’ll need your transaction history in order to track your tax lots. Additionally, for each sale or exchange, you will need the following information:

- Amount and currency of the coin or token sold

- Fiat value at time of acquisition

- Date of acquisition

- Fiat value at time of trade or sale

- Date of sale

It is very important to keep detailed records because trades are challenging to backfill, and any missing cost basis increases your tax liability.

You can back-fill missing data from receipts and exchange transaction confirmation emails, but it is much simpler to back up your information from exchanges regularly. Keeping notes on special situations, such as lost coins and ICOs, will also help you fill out your tax forms. Our accountants are also experienced in handling missing data for tax calculations.

Crypto tax calculation example

Once you’ve assembled your full transaction history, you can start calculating your capital gains and losses. To illustrate the specific details of the calculation, let’s walk through some concrete examples of how to match up crypto trades.

If you bought bitcoin, traded short term for litecoin, and then sold that litecoin long term for fiat, your trades in chronological order would be as represented below. Your capital gains tax calculation will be split out between short-term and long-term trades held for a duration of less than a year or greater than a year, respectively.

- You bought 1 BTC for $8, (including fees), thus your cost basis for this lot of 1 BTC is $8,

- You sold this 1 BTC for $10, (including fees) worth of LTC the next day, thus the proceeds are $10,

- Subtract the cost basis of $8, from the proceeds of $10,, and your gain is $2,, that amount of which you are liable for short term capital gains tax on.

- More than a year later, you sold the $10, LTC for $11, (including fees) in dollars, thus the proceeds are $11,

- Similarly, subtract the cost basis of $10, from the proceeds of $11,, and your gain is $1,, that amount of which you are liable for long term capital gains tax on.

How to calculate crypto taxes

At its core, calculating crypto taxes is matching sales of crypto to their respective cost basis (the price originally paid for that crypto), and then calculating the gain or loss from this sale.

However, it gets a little trickier if you have multiple cost bases for a lot of crypto that you sell. For example, if you buy 1 BTC in for $1,, and 1 BTC for $12, in , and then sell 1 BTC in for $10, in , which cost basis do you use?

Accounting methods like FIFO, LIFO, and Minimization determine which cost basis is used in the above case. FIFO (First in, first out) for example would choose the earlier BTC buy — 1 BTC for $1, in — as the cost basis for that sale in , leading to a $9, profit.

Most of the time, an accounting method like described above will be required, as the divisible nature of crypto means that many sales will either need to choose from multiple cost bases, or a single sale can have multiple cost bases. In the case of the latter, one say would be split out into multiple lines on the , each with a different cost basis and gain / loss calculation.

If you just have a few crypto trades overall, it may be easy to manually calculate the gain and loss for each sale during the tax year and then enter those on the Form However, if you used multiple exchanges, sold coins with multiple cost bases, and held positions over multiple years, you may find it easier to use a crypto tax calculator platform.

Cryptocurrency capital gains and losses only count towards your taxes once realized

Gains on crypto (and property in general) are not “realized” until you sell, exchange, or spend the asset. This means that if you only bought BTC once and held it, never selling or exchanging it, then you don’t have any realized, taxable gains or losses — only unrealized gains or losses. If you are holding a crypto asset at a loss, you can only claim that loss by selling the asset.

It’s good practice to be mindful of what your unrealized gains/losses are. Many crypto traders were caught off guard when handling their and crypto taxes, as they may have exchanged their BTC for altcoins — triggering a large gain at the end of due to the market’s peak.

Then, when those altcoins dropped in value, they were expecting a loss when filing for taxes, only to realize that they couldn’t claim the loss because they hadn’t sold those coins yet, thus not having realized the loss.

Keep an eye on your unrealized gains and losses with tax tools

Remember: you only are liable for tax when you have realized gains. But also keep in mind that you can only claim losses on your taxes if you have realized the losses.

Our Tax Loss Harvesting tool can help you keep tabs on what your unrealized gains and losses are, so that you can strategically harvest your losses to potentially lower your tax liability. You'll be able to see what unrealized gains you have as well.

Is like-kind exchange allowed for crypto?

Like-kind exchange is where you exchange one asset for another similar asset without recognizing capital gains or losses in the transaction.

As of , like-kind is specifically disallowed for crypto. It can only be used for real estate.

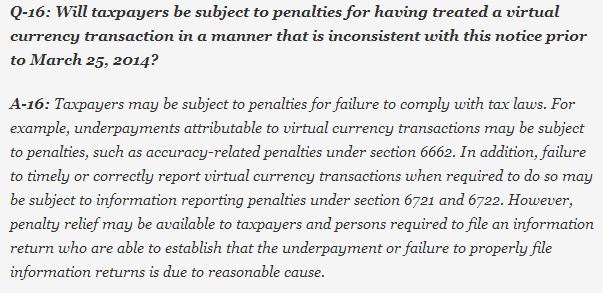

For tax years and before, there has been no specific IRS guidance on whether like kind exchange is allowed, so a few taxpayers have elected to calculate their crypto with like kind with the idea that different cryptocurrencies are similar assets.

Furthermore, it’s unclear whether separate cryptocurrencies “substantially similar” enough to qualify for like kind exchange. It is possible that the IRS may issue guidance that states that like kind was or wasn’t allowed, the latter possibly resulting in taxpayers needing to amend their return.

According to Bloomberg, IRS officials stated at a tax conference that like-kind is not allowed for pre crypto tax filings. However, this has not been confirmed with official tax policy.

We help our VIP clients calculate their crypto in like kind if they deem it acceptable to do so in discussing with a tax professional.

How to use a crypto tax calculator to calculate your crypto taxes

Crypto tax calculators work by aggregating your data and then automatically linking your cost bases to your sales, using accounting methods like FIFO or LIFO. They calculate your gains or losses and automatically populate tax reports with your data.

These are the steps you’d go through when using a bitcoin tax calculator:

- Import all your cryptocurrency exchange trade history, as well as any transactions made off-exchange.

- Verify that all historical data has been imported, and that your crypto taxes are calculated properly.

- Decide on an accounting method.

- Export your tax forms.

- Include your crypto taxes on your return!

Interested in using a calculator platform for your crypto taxes to automate the process? Read our article on crypto tax software to learn more.

-