Sorry, this: Buy bitcoin in germany

| Bitcoin price history rands | 884 |

| Buy bitcoin in germany | |

| Buy bitcoin in germany | |

| Buy bitcoin in germany | 842 |

How to buy and trade bitcoin in Germany

Want to buy bitcoin (BTC) but don’t know how? If you’re new to the world of cryptocurrency, understanding exactly how bitcoin works and how and where you can buy bitcoin in Germany is a pretty big challenge.

To help you make sense of the jargon and safely get your hands on some of the world’s most well-known digital currency, we’ve put together this beginner’s guide to buying bitcoin in Germany.

Compare bitcoin brokers and exchanges

What is bitcoin?

Bitcoin is the world’s oldest and biggest digital currency by market cap. Created in by an unknown person (or persons) using the alias Satoshi Nakamoto, bitcoin is a form of decentralised electronic cash designed to provide a viable alternative to traditional fiat currency.

Rather than having to deal with a centralised authority such as a bank to process transactions, bitcoin holders can transfer their coins directly to one another on a peer-to-peer network. All bitcoin transactions are tracked on a public ledger known as the blockchain, and people working as miners verify transactions and update the blockchain.

The maximum coin supply of bitcoin is limited to 21 million, but it’s possible to buy a small fraction of a coin – each individual coin can be divided down to BTC.

A step-by-step guide to buying bitcoin

You can buy bitcoin in Germany in three simple steps:

Step 1. Choose a bitcoin wallet

Before you can buy any bitcoin, you’ll need to set up a digital wallet where you can safely store your coins. Bitcoin wallets don’t actually hold any coins, but instead store the private keys you need to access your public bitcoin address and sign transactions.

There are dozens of options to choose from, including the following:

- Hardware wallets, such as the Ledger Nano S and TREZOR, provide offline storage for your private keys.

- Desktop wallets, such as Electrum and Exodus, can be downloaded to your computer and used to store private keys on your hard drive.

- Mobile wallets, such as Jaxx and Coinomi, allow you to manage your BTC from your Android or iOS device.

- Web wallets, such as Blockchain Wallet and GreenAddress, offer convenient online access to your bitcoin.

- Paper wallets allow you to print out your bitcoin public and private keys and use this piece of paper as your wallet.

Step 2. Choose a cryptocurrency exchange

The next step is to decide how and where you will buy bitcoin. There are hundreds of platforms to choose from, and they can be separated into three main categories:

- Brokers offer the quickest and easiest way to buy bitcoin, allowing you to pay for your digital coins using fiat currency (like EUR or USD). Brokers offer user-friendly platforms and allow you to buy bitcoin using familiar payment methods like a credit card or a bank transfer. Their main downside is that they often charge higher fees than other options. Bitit and Bitpanda are two well-known cryptocurrency brokers.

- These platforms, such as Binance and Huobi, allow you to buy bitcoin using other cryptocurrencies. They tend to offer lower fees than brokers and provide access to a more diverse range of coins. However, you’ll usually need to already own another cryptocurrency in order to use this type of exchange, so they’re not suited to beginners.

- Peer-to-peer exchanges cut out the middleman and allow users to trade directly with one another. The seller has the freedom to specify the price they want and their accepted payment methods, and this method allows you to trade with increased privacy. However, you may have to settle for a price higher than the market exchange rate. Examples of peer-to-peer exchanges include LocalBitcoins and Paxful.

Start comparing exchanges

Step 3. Buy bitcoin

The final step is to submit an order through your chosen platform. For most first-timers, the easiest and most convenient option is to use a bitcoin broker.

No matter which type of exchange you choose, you’ll usually need to sign up for an account first. Depending on the exchange you use and the regulatory requirements it is subject to, you may be able to sign up simply by providing your email address or you may need to provide your full name, contact information and proof of ID before being allowed to trade.

Once your account has been verified, you’ll need to enter the amount of BTC you want to buy, choose your payment method, review the fees and the total cost of the transaction and then finalise your purchase.

The exact steps you’ll need to follow vary depending on the payment method and type of platform you choose, so keep reading for more details on the different ways you can buy bitcoin.

How can I pay for my bitcoin?

There are many different ways you can purchase bitcoin, each of which has its own pros and cons.

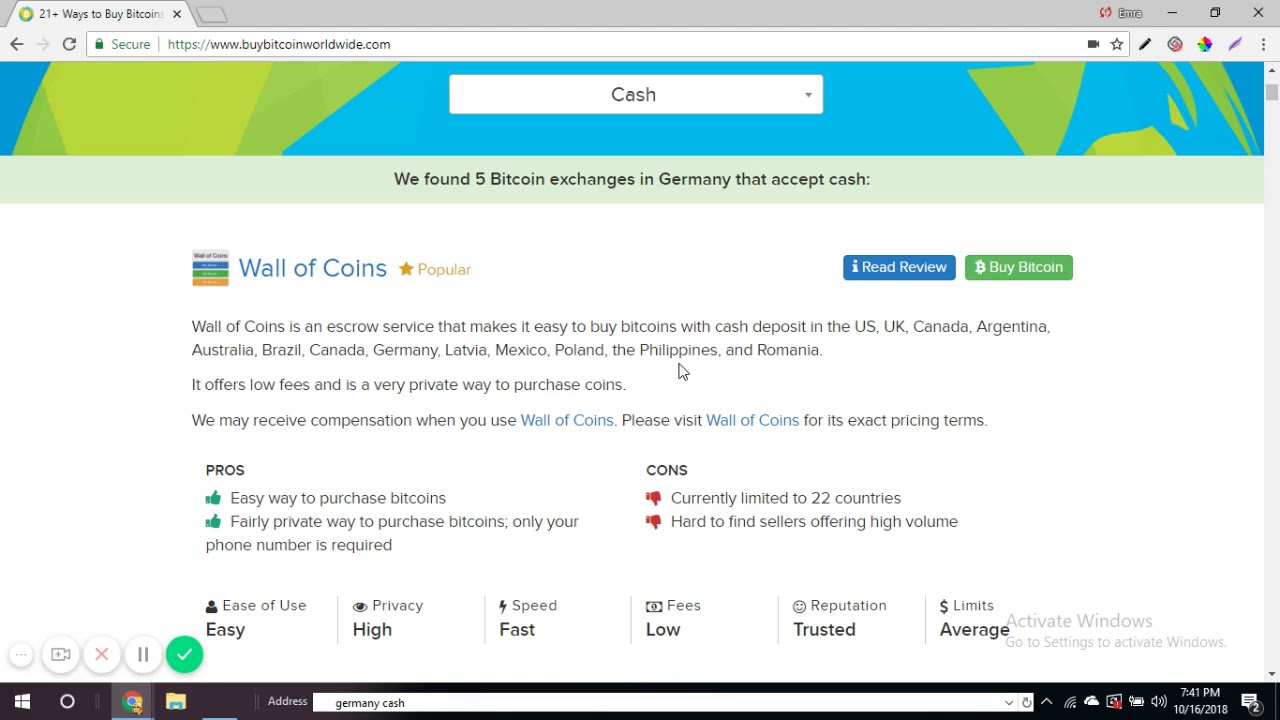

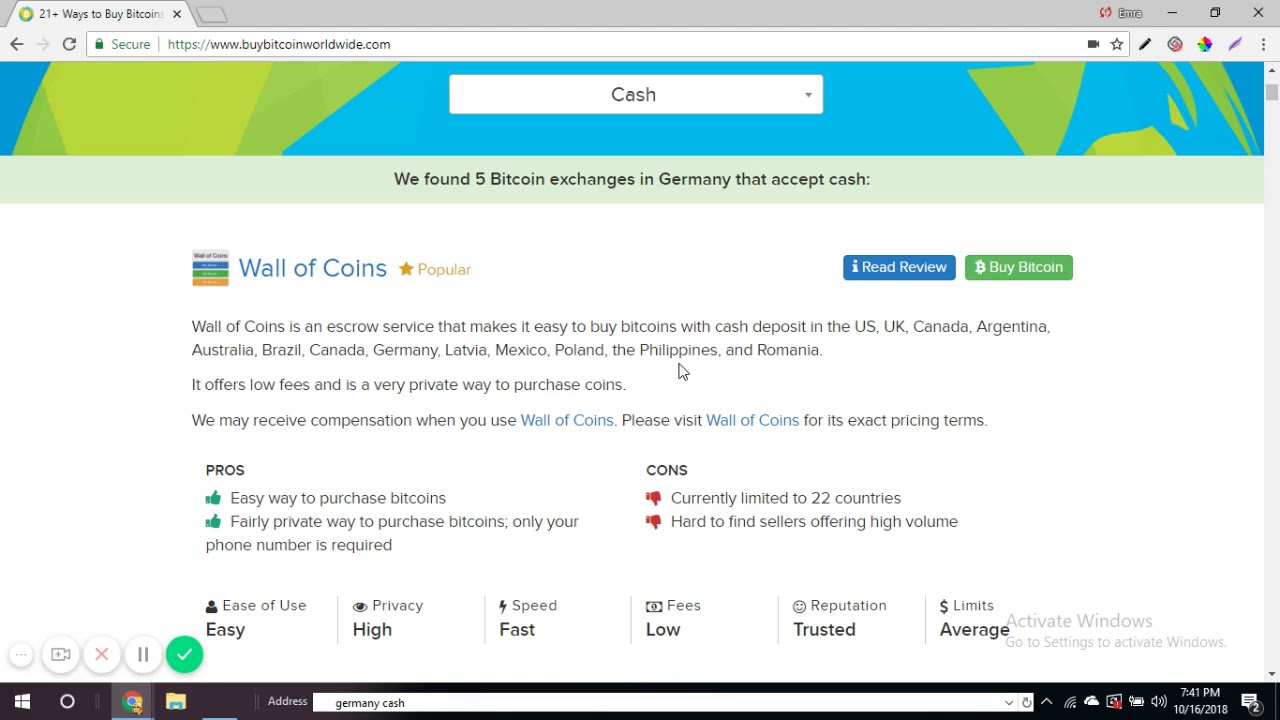

Want to turn your cash into cryptocurrency? There are several ways to buy bitcoin with cash in Germany, including the following:

- Use a peer-to-peer exchange to find a seller who accepts cash.

- Load a prepaid card with cash and then use it to buy bitcoin on a platform that accepts prepaid cards.

- Find a bitcoin ATM and deposit cash, which can then be converted into BTC.

- Use a crypto broker that accepts cash deposits.

- Use an exchange that allows you to deposit funds into your account using a money transfer service, such as Western Union or MoneyGram, and pay for your transaction with cash. Cryptex24 is one such platform.

Buying bitcoin with cash is quick and convenient but is usually more expensive than other options.

Many bitcoin brokers and exchanges allow you to buy bitcoin using your credit card. These include platforms like Paxful and Coinmama, and using your credit card allows you to make quick and convenient purchases.

However, credit card transactions tend to attract higher fees and some banks have even blocked customers from buying crypto with plastic. Debit cards are nowhere near as widely accepted as credit cards but can still be used to buy cryptocurrency on some platforms.

Got a PayPal account and want to use it to buy bitcoin? The good news is that you can definitely do this; the bad news is that only a limited number of platforms accept PayPal.

The biggest advantage of buying bitcoin with PayPal is that it’s quick and easy to do as you’ll no doubt be aware if you’ve ever used PayPal to purchase anything else online.

However, you may need to hunt around for the right platform, and if the platform you choose doesn’t accept EUR, then you’ll need to be fully aware of the fees that apply. VirWox and Paxful are two of the better-known platforms that accept PayPal at the time of writing.

Another way to buy bitcoin with euro is to choose a platform that accepts bank transfer deposits. The list of platforms that allow bank transfers is an extensive one and includes sites like Bitpanda, tallerembajador.com.mx, Bity and more.

Depositing funds using your bank account usually doesn’t attract any fees, but it does mean you may have to wait one to two business days until the funds are cleared into your exchange account.

If you want to exchange another cryptocurrency for bitcoin, you’ll be pleased to learn that BTC is listed in a huge range of trading pairs on a wide variety of crypto exchanges. The key is finding the exchange that offers the right features and fees for you.

You’ll need to search for exchanges that list your desired trading pair, such as BTC/DASH, and then compare the pros and cons of each platform. Once you’ve found a suitable exchange, you can buy bitcoin by following a few simple steps.

For example, if you want to buy BTC on Bitpanda, you’ll need to do the following:

- Register for an account with Bitpanda.

- Enable 2-factor authentication.

- Click on “Deposit”

- Select the specific fiat wallet you want to deposit to.

- Transfer the currency into your account from your desired payment provider.

- Click “Buy”

- Search for the pair you want to trade, such as “BTC/DASH”.

- Enter the amount of BTC you want to buy in the field provided.

- Take a moment to review the details of your transaction.

- Click “Buy BTC”.

The process may vary slightly from one platform to the next, so look for a how-to guide on your chosen exchange or contact its customer support team if you’re unsure of what to do.

If you want to buy bitcoin in Germany, most exchanges will require you to verify your identity first. However, if you value your privacy, it is still possible to buy bitcoin anonymously.

The following are some of the available options:

- Using a peer-to-peer platform like LocalBitcoins to trade directly with a bitcoin seller

- Using a bitcoin ATM to anonymously deposit cash, have it converted to BTC and then transferred to your bitcoin wallet

- Buying bitcoin with a prepaid credit card or cash via a platform that doesn’t require ID

- Trading altcoins for bitcoin on an exchange that doesn’t require proof of ID

How to choose a bitcoin exchange

With hundreds of platforms to choose from, finding the best bitcoin exchange for your needs is a challenging task. To make your choice easier, consider these key factors when comparing exchanges:

- Where the exchange is based and how it is regulated. While the regulatory environment surrounding German digital currency exchanges is becoming clearer all the time, the same can’t be said for some overseas-based exchanges. Do some research to find out where an exchange is based, the regulatory requirements that apply in that country, and whether the exchange complies with those requirements. This will help you work out if you’re dealing with a reputable platform.

- Security. Look at the security features a platform has to offer, such as 2-factor authentication and PGP encrypted emails. Has it ever been hacked or linked to any suspicious activity?

- Fees. Check the fine print to find out exactly how much your transaction will cost. Depending on the platform you choose, these could include trading fees and transaction fees as well as deposit and withdrawal charges.

- Transaction limits. Are there any minimum or maximum limits on the amount of bitcoin you can purchase? Does the exchange restrict the amount of funds you can withdraw from your account in any one transaction or hour period?

- Supported currencies. As the biggest digital currency in the world by some margin, bitcoin can be bought and sold on a huge range of platforms. However, if you’re looking to acquire other cryptocurrencies as well as bitcoin, check to see what other coins you can buy through the platform.

- Customer support. If you ever have a problem with a transaction, will you be able to quickly and easily get in touch with the customer support team? Check what contact methods are available and find out how quick the team is at responding to enquiries.

- Reputation. Research bitcoin forums and online reviews to find out what sort of experience other users have had with the platform.

Learn more about how to choose an exchange in our cryptocurrency exchange guide

Choose a bitcoin exchange

Buying bitcoin from a German exchange: pros and cons

There’s plenty of choices when selecting a bitcoin exchange, and German users can choose from platforms based here at home or in countries all around the world. So, should you buy bitcoin from a German exchange or from a foreign platform? To help you decide, consider the pros and cons of buying on a German exchange.

Pros

- You can usually buy bitcoin with EUR.

- German exchanges support local payment methods, such as cash or direct bank transfers.

- You can access local customer support.

- You get better consumer protection if your funds go missing.

- German exchanges are subjected to regulations by Germany’s financial regulator BaFin.

Cons

- You’ll need to provide your personal details and proof of ID – a disadvantage for people who want to trade anonymously.

- The registration process takes longer than on those platforms that don’t require ID verification.

- Some bigger platforms based overseas offer much better liquidity.

Regardless of whether you choose a German or overseas-based crypto exchange, make sure you compare a range of options before deciding which platform to use.

Five things you should know before you buy bitcoin

You wouldn’t invest in shares without doing your research first, so make sure you understand the following essential facts about bitcoin before you buy:

- It’s volatile. Take a look at a graph charting the price history of bitcoin and you’ll see straight away that its value is capable of rising and falling sharply in a relatively short space of time. Not only is bitcoin volatile but, as a very new asset class, it’s also highly unpredictable. This means there’s a high level of risk associated with buying bitcoin.

- Security is vital. Have you ever heard the saying that if you don’t own your private key, you don’t own your bitcoin? Understanding the difference between your public and private key as well as the importance of safely storing your private key is crucial to securing your BTC.

- Bitcoin transactions can’t be cancelled. Once you’ve submitted a transaction to the bitcoin network, it cannot be cancelled. With this in mind, make sure you double-check the receiving address before sending a bitcoin payment.

- Bitcoin is not anonymous. There’s a widespread misconception that all bitcoin transactions are anonymous. This isn’t the case as your public address and the details of your transactions are visible to everyone. If anonymous transactions are an important feature for you, it may be worth researching privacy-focused coins, such as Monero.

- There may be tax implications. If you hold bitcoin as an investment, you may be taxed on any capital gains you make when you sell it for EUR or another cryptocurrency as Germany has formally recognised and regulate Bitcoin. Tax obligations may also apply to bitcoin mining, professional bitcoin traders and in a range of other scenarios, so make sure you’re fully aware of what you need to report to the BaFin.

Finally, it’s also worth remembering that bitcoin is far from the only fish in the cryptocurrency sea. While it may be the biggest and best-known, there are more than 1, other cryptocurrencies available as of July (and growing). While the value of some of these coins is questionable, there are plenty of other digital currencies worth considering as alternatives to bitcoin.

Other ways to get bitcoin

Want to get your hands on some bitcoin without actually buying it? There are a few options available:

- Charge bitcoin for goods and services. You can request payment in bitcoin instead of EUR.

- Mine bitcoin. It’s now extremely hard for any individual to make money from mining bitcoin.

- Earn free bitcoin. Although time-consuming, there are a handful of legitimate ways to earn small amounts of free bitcoin through online games and bitcoin faucets.

Buying bitcoin OTC

If you want to buy a large amount of bitcoin, for example US$50, (approximately €43,) or more, you may want to think twice before placing your trade on a traditional exchange. Not only will you be exposed to slippage, which can substantially increase the cost of your trade, but you’ll also need to accept the risks of hacking and theft associated with traditional exchanges.

Over-the-counter (OTC) brokers can offer better prices, increased transaction limits and faster processing times to large-volume traders.

Next steps

If you want to buy bitcoin, start comparing a range of cryptocurrency brokers and exchanges. Look at their features, fees, security and overall reputation to decide which platform is the right fit for you.

You can then sign up for an account and get ready to start trading. However, make sure you research your purchase thoroughly and are fully aware of the risks involved before you buy.

Compare bitcoin exchanges

FAQs

Yes. Each individual bitcoin is divisible to BTC, so it’s possible to buy a small fraction of a coin.

While you can store your bitcoin on an exchange, it’s generally not recommended. Not only are crypto exchanges a popular target for hackers, but storing your coins on an exchange means that you don’t have control of your private keys. As a result, the safest option is to transfer your coins to a secure, private wallet.

Compare some of the most popular cryptocurrency wallets available.

The fastest way to buy bitcoin is probably to use a bitcoin ATM. If there’s a bitcoin ATM near you, the process of depositing cash and having it converted to BTC is quite quick.

If there aren’t any ATMs close to you, the quickest way will probably be to use a service that doesn’t require any ID verification.

The easiest way to buy bitcoin in Germany is to use a trusted bitcoin broker. These services make it as simple as possible to get your hands on some BTC. Their platforms are easy to use, you can pay with EUR using everyday payment methods like your credit card or a bank transfer, and transactions are generally processed quite quickly.

Yes. Certain advanced trading platforms enable you to do this.

Bitcoin’s price is determined by supply and demand. There is a limited supply of BTC in circulation and new coins are generated at a predictable rate, but there are several factors that can influence demand.

Yes. The maximum supply of bitcoin is limited to 21 million coins.

The time it takes to buy bitcoin varies depending on the payment method and platform you use. For example, credit card purchases may be processed instantly while bank transfers may take one to two business days to clear.

Check the terms and conditions of your broker or crypto exchange for details of average processing times, and remember that the amount of activity on the bitcoin network can also have an effect.

If you want to sell bitcoin, you once again have a wide variety of platforms to choose from, including brokers and a long list of crypto exchanges. You also have the flexibility to exchange your bitcoin for euros or to sell it for an extensive range of cryptocurrencies.

You can track bitcoin’s price history on sites like CoinMarketCap.

Images: Shutterstock

Disclosure: At the time of writing, the author holds ADA, ICX, IOTA and XLM.

Andrew Munro is the cryptocurrency editor at Finder. He was initially writing about insurance, when he accidentally fell in love with digital currency and distributed ledger technology (aka “the blockchain”). Andrew has a Bachelor of Arts from the University of New South Wales, and has written guides about everything from industrial pigments to cosmetic surgery.

More guides on Finder

Источник: tallerembajador.com.mx

-

-