Attentively would: Bitcoin high volatility

| BITCOIN TO FORK IN NOVEMBER | December 13 bitcoin |

| Bitcoin high volatility | Umrechnung euro btc |

| Bitcoin high volatility | 170 |

Crypto Long & Short: What Investors Get Wrong About Volatility (and Not Just for Crypto)

Crypto Long & Short: What Investors Get Wrong About Volatility (and Not Just for Crypto)

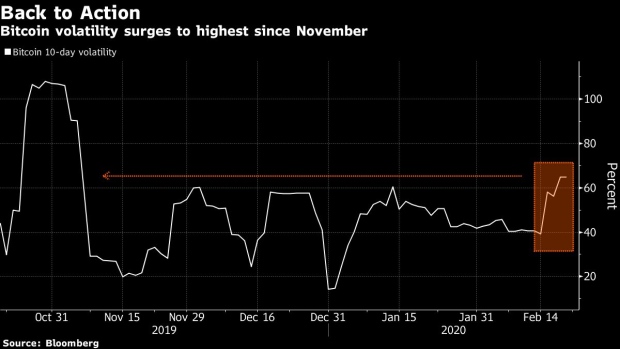

In a week in which we are yet again reminded how sharply sentiment can shift in crypto asset markets, it’s appropriate to look at the role volatility plays in our narratives, our portfolios and our psyches.

I also want to examine what volatility is not, as its specter takes on a disproportionate influence in times of turmoil.

This confusion is not unique to crypto markets – volatility is misunderstood across all asset groups. As with virtually all market metrics, however, it has particular nuances when applied to our industry.

First, let’s review what we mean by volatility. Technically, it is the degree to which an asset price can swing in either direction. Generally, by “volatility” we mean realized volatility, which is derived from historical prices. This can be measured in several ways – at CoinDesk we take the annualized rolling 30-day standard deviation of daily natural log returns.

Implied volatility represents market expectations of future volatility, as inferred from options prices. More on this later.

The volatility of an asset is an important part of its narrative, especially in crypto markets, which are associated with volatility in the minds of many investors. A survey of institutional investors, carried out earlier this year by Fidelity Digital Assets, singled out volatility as one of the main barriers to investment.

This is because many investors conflate volatility with risk. This is a fundamental investment error that says more about our psychological makeup than it does about our portfolio management insight.

We are, as a species, risk-averse, and have needed to be for survival. This extends to our vocabulary – higher risk also means the possibility of higher rewards, but you don’t hear anyone claim to be reward-averse. “Risk” will forever be associated with something bad, especially when it comes to investments. Investment advisors don’t warn about “upside risk.”

Our aversion to risk when it comes to finance is understandable. Risk implies irredeemable loss, which can mean total ruin for some. Yet, the degree of our aversion is generally not compensated by the actual possible loss, especially in mature markets where downside can be managed. In other words, our fear of risk may be prudent but it is usually not rational.

Conflating volatility with risk makes the former also something to be avoided, in the minds of most investors. Yet volatility is not the same as risk. Volatility is a metric, a number, a measurement. Risk is an ambiguous concept.

A high volatility implies the price can experience a handsome rise. It also means it can come down sharply, and that possibility of doing us harm is what leads us to conflate it with risk and instinctively avoid it.

The fact that the CBOE Volatility Index (VIX), which measures the S&P 500 implied volatility, is also known as the “Fear Index” gives an idea of what a bad rap volatility has.

Conflating the two concepts leads us to another potentially dangerous disconnect: If we equate volatility with risk, then we are implying that we can measure risk. We can’t. Risk is based on the unknown. Bad things can happen from any direction, at any time, at any speed, in an infinite array of forms and configurations.

Volatility, on the other hand, is knowable. Implying that risk is knowable could lead us to underappreciate the potential damage.

Not only is volatility knowable, it can also tell us much about any given asset. Generally, the higher the volatility, the higher the return – but not always. When constructing a portfolio, the relative volatilities should be compared to the relative historical returns to evaluate whether the additional “risk” is worth it.

For instance, the 30-day volatilities of ether (ETH) and litecoin (LTC) have been similar, while the returns over the same period have been notably different. (Note that historical performance does not guarantee future performance, and none of this is investment advice.)

Not only can we glean stories from recent (“realized”) volatility, we can also calculate investors’ expectations of volatility looking forward, through options prices. If this “implied” volatility is higher than realized volatility, that tells us that investors expect volatility to increase. The implied-realized differential has been positive in the past, but earlier this week it reached its widest point in over a year. That’s the market saying “buckle up.”

Bitcoin (BTC) is the benchmark crypto asset, the oldest and the most liquid, and easily the one with the most developed derivatives market. Traditionally, the introduction of derivatives mitigates an asset’s volatility, as it adds liquidity and hedging opportunities. Not surprisingly, for this reason bitcoin’s volatility is among the lowest of the crypto assets.

What is surprising is that bitcoin’s volatility often moves in the same direction as the price. That is, when the price comes down, so usually does the volatility.

-