Mining pool

In the context of cryptocurrency mining, a mining pool is the pooling of resources by miners, who share their processing power over a network, to split the reward equally, according to the amount of work they contributed to the probability of finding a block. A "share" is awarded to members of the mining pool who present a valid partial proof-of-work. Mining in pools began when the difficulty for mining increased to the point where it could take centuries for slower miners to generate a block. The solution to this problem was for miners to pool their resources so they could generate blocks more quickly and therefore receive a portion of the block reward on a consistent basis, rather than randomly once every few years.[1][2][3]

History[edit]

- Late Slush launched the first mining pool

- – The era of deepbit, which at its peak, shares up to 45% of the network hashrate

- – Since the introduction of ASIC, and when deepbit failed to support the newer stratum protocol, tallerembajador.com.mx replaced deepbit and became the largest

- – Rise of China. F2Pool which launched in May , replaced tallerembajador.com.mx and became then the largest mining pool

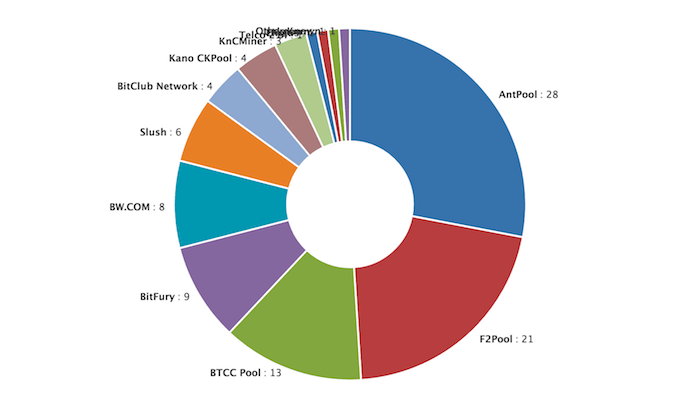

- – Rise of Bitmain and its AntPool. Bitmain also controls a few other smaller pools like tallerembajador.com.mx and ViaBTC

- – The launch of Poolin. Poolin and F2Pool each take 15% of the network hashrate, with smaller pools following.

- Binance launches a mining pool following Huobi and OKex. Luxor launches a US-based mining pool.

Mining pool share[edit]

Share is the principal concept of the mining pool operation. Share is a potential block solution. So it may be a block solution, but it is not necessarily so. For example, suppose a block solution is a number that ends with 10 zeros and, a share may be a number with 5 zeros at the end. Sooner or later one of the shares will have not only 5, but 10 zeros at the end, and this will be the block solution.

Mining pools need shares to estimate the miner's contribution to the work performed by the pool to find a block. There are numerous miner reward systems: PPS, PROP, PPLNS, PPLNT, and many more.

Mining pool methods[edit]

Mining pools may contain hundreds or thousands of miners using specialized protocols.[4] In all these schemes stands for a block reward minus pool fee and

is a probability of finding a block in a share attempt (

, where

is current block difficulty). A pool can support "variable share difficulty" feature, which means that a miner can select the share target (the lower bound of share difficulty) on his own and change

accordingly.

Pay-per-Share[edit]

The Pay-per-Share (PPS) approach offers an instant, guaranteed payout to a miner for his contribution to the probability that the pool finds a block. Miners are paid out from the pool's existing balance and can withdraw their payout immediately. This model allows for the least possible variance in payment for miners while also transferring much of the risk to the pool's operator.

Each share costs exactly the expected value of each hash attempt .

Proportional[edit]

Miners earn shares until the pool finds a block (the end of the mining round). After that each user gets reward , where

is amount of his own shares, and

is amount of all shares in this round. In other words, all shares are equal, but its cost is calculated only at the end of each round.

Bitcoin Pooled mining[edit]

Bitcoin Pooled mining (BPM), also known as "slush's system", due to its first use on a pool called "slush's pool', uses a system where older shares from the beginning of a block round are given less weight than more recent shares. A new round starts the moment the pool solves a block and miners are rewarded Proportional to the shares submitted.[5] This reduces the ability to cheat the mining pool system by switching pools during a round, to maximize profit.

Pay-per-last-N-shares[edit]

Pay-per-last-N-shares (PPLNS) method is similar to Proportional, but the miner's reward is calculated on a basis of N last shares, instead of all shares for the last round. It means that when a block is found, the reward of each miner is calculated based on the miner contribution to the last N pool shares. Therefore, if the round was short enough all miners get more profit and vice versa.

Solo Mining Pool[edit]

Solo pools operate the same way as usual pools, with the only difference being that block reward is not distributed among all miners. The entire reward in a solo pool goes to the miner who finds the block.

Peer-to-Peer Mining Pool[edit]

Peer-to-peer mining pool (P2Pool) decentralizes the responsibilities of a pool server, removing the chance of the pool operator cheating or the server being a single point of failure. Miners work on a side blockchain called a share chain, mining at a lower difficulty at a rate of one share block per 30 seconds. Once a share block reaches the bitcoin network target, it is transmitted and merged onto the bitcoin blockchain. Miners are rewarded when this occurs proportional to the shares submitted prior to the target block. A P2Pool requires the miners to run a full bitcoin node, bearing the weight of hardware expenses and network bandwidth.[5][6]

Geometric method[edit]

Geometric Method (GM) was invented by Meni Rosenfeld.[7] It is based on the same "score" idea, as Slush's method: the score granted for every new share, relatively to already existing score and the score of future shares, is always the same, thus there is no advantage to mining early or late in the round.

The method goes as follows:

Double Geometric method[edit]

Generalized version of Geometric and PPLNS methods.[7] It involves new parameter: ("cross-round leakage"). When

this becomes the Geometric method. When

this becomes a variant of PPLNS, with exponential decay instead of a step function.

- Choose parameters

,

, and

.

- When the pool first starts running, initialize

. For every worker

, let

be the worker's score, and set

.

- Set

. If at any point the difficulty or the parameters change,

should be recalculated.

- When worker

submits a share, set

(where

is the block reward at the time it was submitted), and then

.

- If the share is a valid block, then also do the following for each worker

: Give him a payout of

, and then set

.

Transaction Fees[edit]

Usually, the blocks in the cryptocurrency network contain transcations. Transaction fees are paid to the miner (mining pool). Different mining pools could share these fees between their miners or not. Pay-per-last-N-shares (PPLNS), Pay-Per-Share Plus (PPS+) or Full Pay-Per-Share (FPPS) are the most fair methods where the payouts from the pool include not only the block subsidy but also the transaction fees.

Multipool mining[edit]

Multipools switch between different altcoins and constantly calculate which coin is at that moment the most profitable to mine. Two key factors are involved in the algorithm that calculates profitability, the block time, and the price on the exchanges. To avoid the need for many different wallets for all possible minable coins, multipools may automatically exchange the mined coin to a coin that is accepted in the mainstream (for example bitcoin). Using this method, because the most profitable coins are being mined and then sold for the intended coin, it is possible to receive more coins in the intended currency than by mining that currency alone. This method also increases demand on the intended coin, which has the side effect of increasing or stabilizing the value of the intended coin.[citation needed]

See also[edit]

References[edit]

- ^"Individual mining vs mining pool". Archived from the original on 21 March

- ^Ittay Eyal with Emin Gün Sirer:"Majority is not Enough: Bitcoin Mining is VulnerableArchived at the Wayback Machine" in the 18th International Conference on Financial Cryptography and Data Security(FC)

- ^Eyal, Ittay. "The Miner's Dilemma"(PDF). Cornell University. Archived(PDF) from the original on Retrieved , In the IEEE Symposium on Security and Privacy (Oakland),

- ^Antonopoulos, Andreas M. (). Mastering Bitcoin. Unlocking Digital Cryptocurrencies. Sebastopol, CA: O'Reilly Media. p.&#; ISBN&#;. Archived from the original on 1 December Retrieved 7 January

- ^ abPedro., Franco (). Understanding bitcoin&#;: cryptography, engineering and economics. Chichester, West Sussex: John Wiley & Sons. ISBN&#;. OCLC&#;

- ^Antonopoulos, Andreas (). Mastering Bitcoin: Programming the Open Blockchain. O' Reilly Media. ISBN&#;.

- ^ abRosenfeld, Meni (November 17, ). Analysis of Bitcoin Pooled Mining Reward Systems. arXiv BibcodearXivR.

0 thoughts to “Mining pool payout btc”