Efficacy of methods/decisions is dependent upon the quality of the cash flow assumptions. In short (Operating expenses = Before-tax cash flow (BTCF). The lender may also constrain activity by increasing the debt coverage ratio (DCR), which is the property net So-called "break-even cash flow" is that condition where loan payments equal net income, or before-tax cash flow (BTCF) is zero. You can also see Excel Matrix Templates. With Debt Service, there is non-cash interest for properties, just as there is for companies (it's also called Before Tax Cash Flow (BTCF) If your NOI figures are off, then your valuation will be off as.

before-tax cash flow

Year 0 Year 1 Year 2 Year 3 PANEL A Before-tax cash flow($1,000) $100 $100 $1,100 (CF) Basis $1,000 $1,000 $1,000 $1,000 Taxes on coupons ($28) ($28) ($28) After-tax CF ($1,000) $72 $72 $1,072 After-tax yield (IRR) 7.20% PANEL B Basis $918.71 $956.52 $1,000 Accrued interest 81.29 Taxes on accrued ($22.76) interest Capital loss -81.29 Tax shield from $22.76 capital loss After-tax CF ($1,000) $94.76 $72 $1,049.24 After-tax yield (IRR) 7.31% Incremental after-tax CF $22.76 $0 ($22.76) EXHIBIT 3 Incremental After-Tax Cash Flows of Increasing-the-Basis- Above-Par Strategy The bond has 10% annual coupon, three-year maturity, is purchased at par, and the yield changes from 10% at the beginning of the Year 1 to 5% at the end of Year 3.

Taxes and bond returns

PGI = Potential gross income V&RL = Vacancy and rent loss EGI = Effective gross income OE = Operating expenses NOI = Net operating income DS = Debt service + interest BTCF = Before-tax cash flowTAXES = Federal and state income taxes ATCF = After-tax cash flow

Project feasibility using breakeven point analysis

Subtracting $80 interest expense, before-tax cash flow is $20.

Interest expense (10% of an $800 loan) is also subtracted, to result in annual before-tax cash flow of $20.

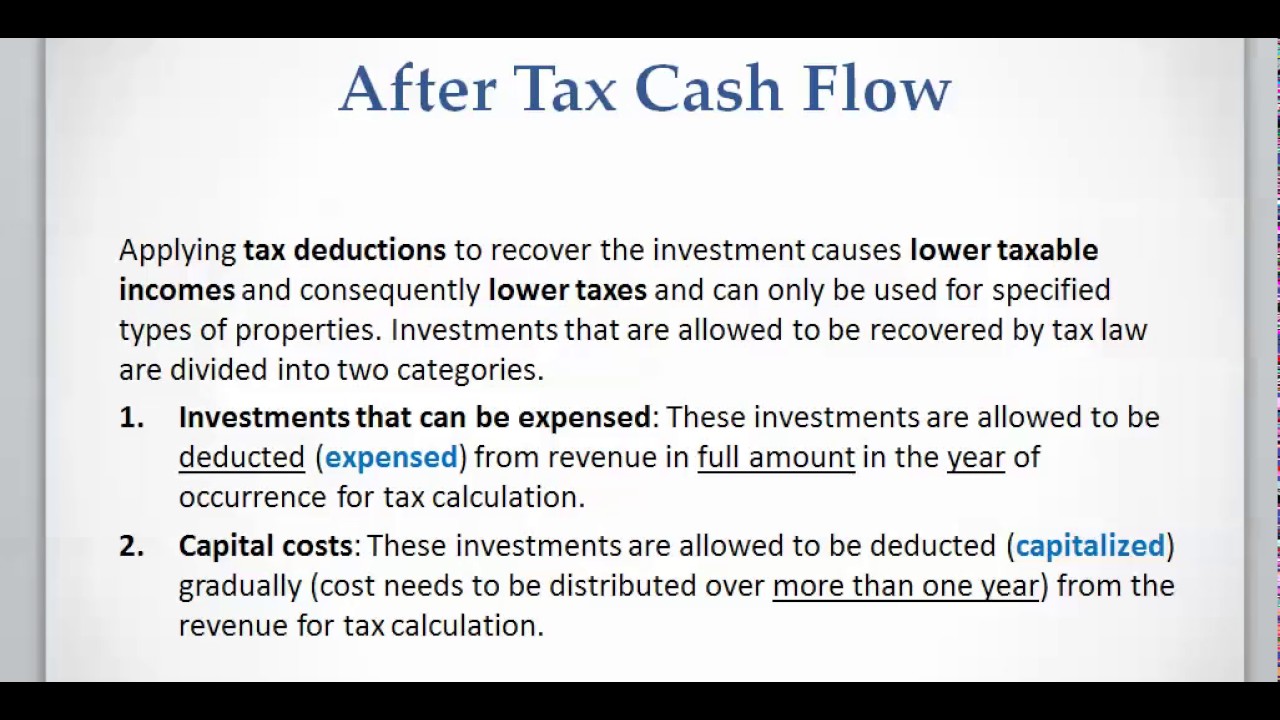

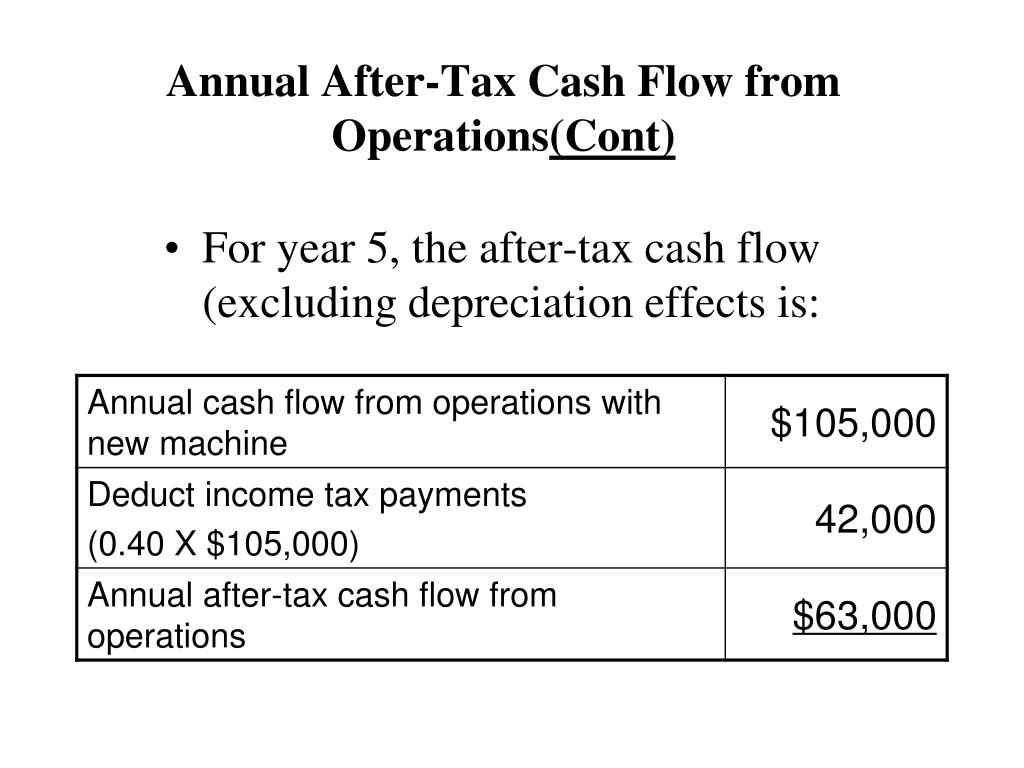

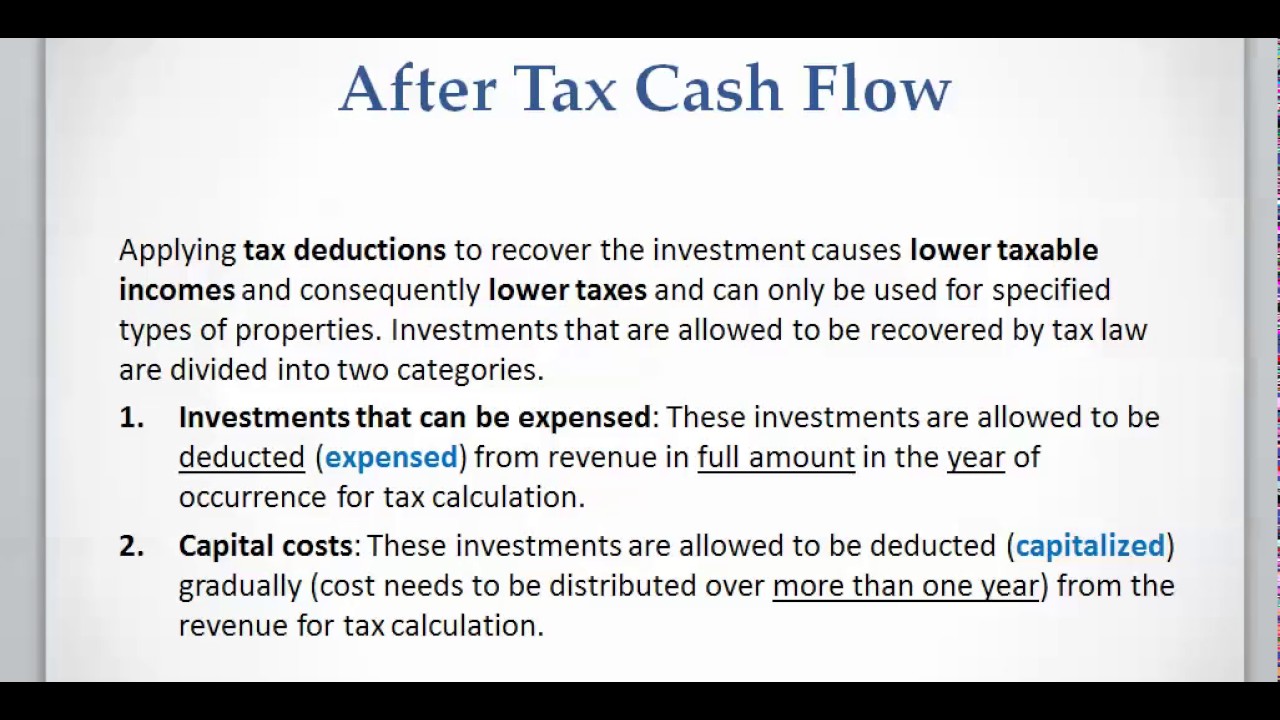

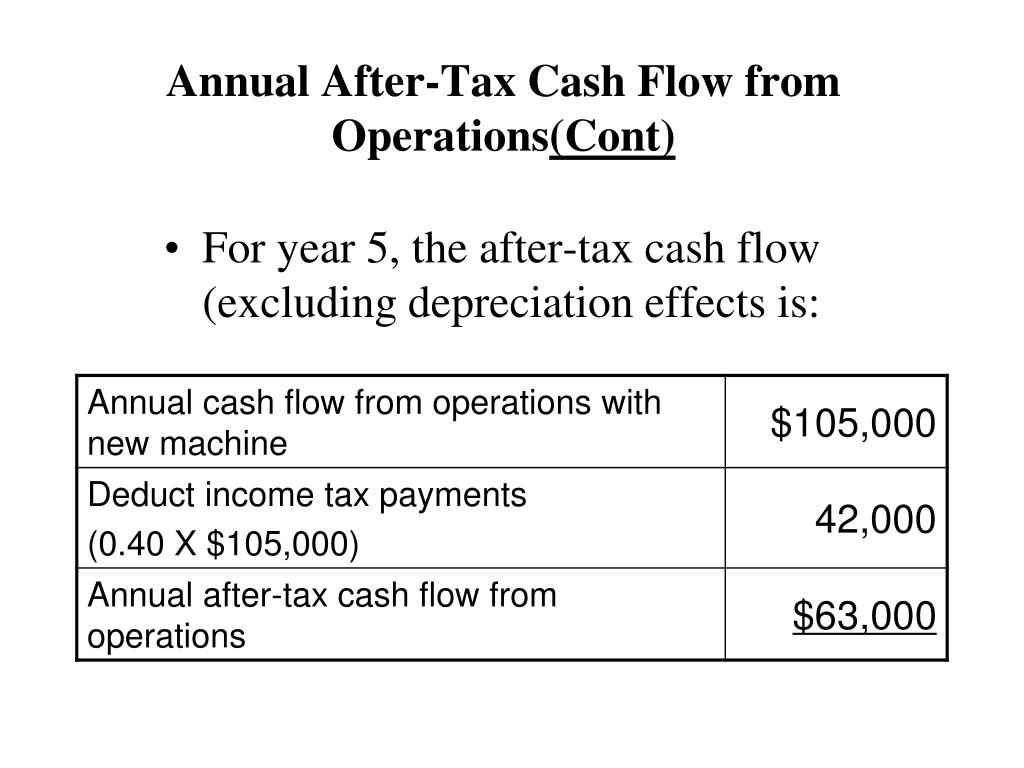

That tax is then subtracted from the before-tax cash flow. If taxable income is zero, there is no income tax in that year, so after-tax cash flow is the same as before-tax cash flow.

Again, it should be noted in Table 2 that the property generates $20 of before-tax cash flow. Because of the non-cash deduction for depreciation, a tax loss of $9.09 is provided each year.

Other simulations were run in which before-tax cash flow was less than the benchmark, and accordingly, tax losses were greater.

Implications of the 1993 Tax Act for real estate investments

Источник: //financial-dictionary.thefreedictionary.com/

0 thoughts to “The before-tax cash flow (btcf) is also called”