Bitcoin address for mining - quite good

Now that you have Bitcoin mining hardware, your next step is to join a Bitcoin mining pool.

Now that you have Bitcoin mining hardware, your next step is to join a Bitcoin mining pool.

What is a Mining Pool?

Mining pools are groups of cooperating miners who agree to share block rewards in proportion to their contributed mining hash power.

While mining pools are desirable to the average miner as they smooth out rewards and make them more predictable, they unfortunately concentrate power to the mining pool’s owner.

Miners can, however, choose to redirect their hashing power to a different mining pool at anytime.

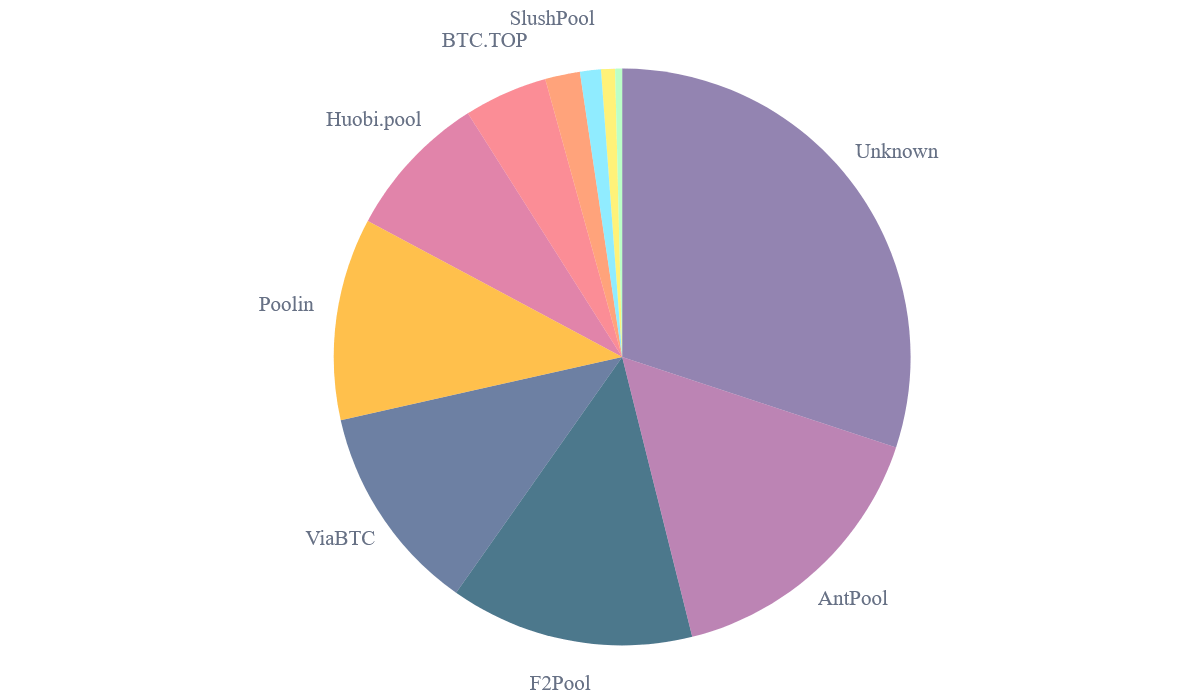

Pool Concentration in China

Before we get into the best mining pools to join, it’s important to note that most mining pools are in China. Many only have Chinese websites and support. Mining centralization in China is one of Bitcoin’s biggest issues at the moment.

There are about 20 major mining pools. Broken down by the percent of hash power controlled by a pool, and the location of that pool’s company, we estimate that Chinese pools control ~81% of the network hash rate:

Bitcoin Wallets

Before joining a mining pool:

You’ll need a bitcoin wallet. Why?

This is because all Bitcoin mining pools will ask you for a Bitcoin address that will be used to send your mining rewards and payouts.

Our guide on the best bitcoin wallets will help you get a wallet. Read the full guide.

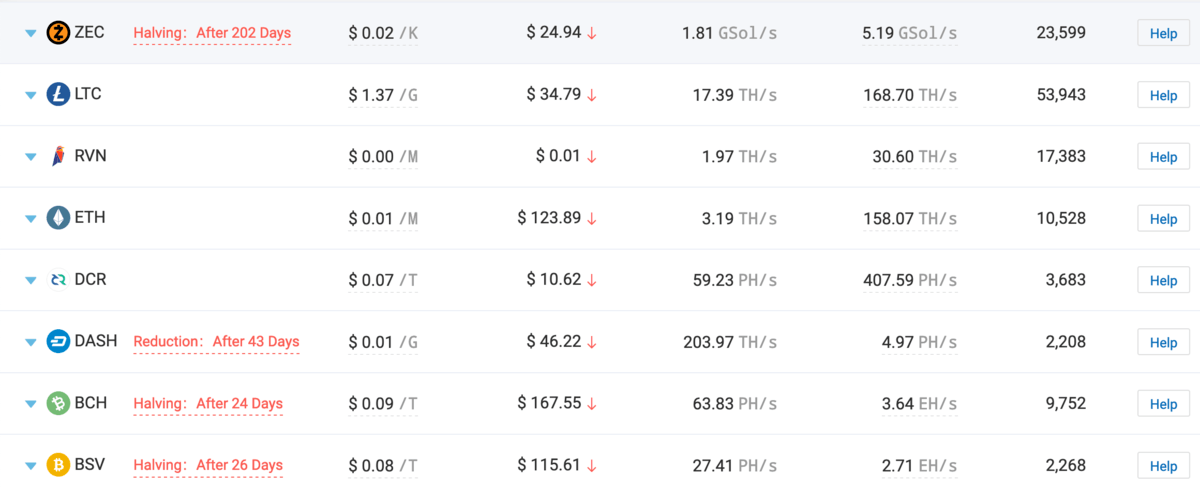

The Biggest Mining Pools

The list below details the biggest Bitcoin mining pools:

We strongly recommend new miners to join Poolin or Slush Pool.

1. Poolin

Poolin is a public pool which mines about 13% of all blocks. They are based in China, but have a website fully available in English.

2. F2pool

F2Pool is based in China. It mines about 19% of all blocks.

3. BTC.com

BTC.com is a public mining pool that can be joined and mines 1.5% of all block. We strongly recommend joining Slush Pool or Poolin instead.

4. Antpool

Antpool is a mining pool based in China and owned by BitMain. Antpool mines about 11% of all blocks.

5. ViaBTC

ViaBTC is a somewhat new mining pool that has been around for about one year. It’s targeted towards Chinese miners and mines about 8% of all blocks.

6. 1THash & 58coin

This is a Chinese pool made from two pools: 1THash and 58coin. They mine about 6% of the blocks.

7. Slush

Slush Pool was the first mining pool and currently mines about 11% of all blocks.

Slush is probably one of the best and most popular mining pools despite not being one of the largest.

8. BTC.top

BTC.top is a private Chinese mining pool and cannot be joined. It mines about 2.7% of all blocks.

9. Bitfury

Bitfury is a private pool that cannot be joined. Bitfury currently mines about 3.5% of all blocks.

Bitcoin Mining Pool Comparison

| Pool | Location | Fees | Private Pool |

|---|---|---|---|

| BitFury | Georgia | 0% | Yes |

| Slush Pool | Czech Republic | 2% | No |

| Antpool | China | 1% | No |

| BW | China | 1% | No |

The comparison chart above is just a quick reference. The location of a pool does not matter all that much. Most of the pools have servers in every country so even if the mining pool is based in China, you could connect to a server in the US, for example.

Get a Bitcoin Wallet and Mining Software

Before you join a mining pool you will also need Bitcoin mining software and a Bitcoin wallet. You will also very likely need an ASIC miner, since GPU mining will likely never be profitable again going forward.

Mining Pools vs Cloud Mining

Many people read about mining pools and think it is just a group that pays out free bitcoins. This is not true! Mining pools are for people who have mining hardware to split profits.

Many people get mining pools confused with cloud mining. Cloud mining is where you pay a service provider to mine for you and you get the rewards.

Just Want Bitcoins?

If you just want bitcoins, mining is NOT the best way to obtain coins.

Buying bitcoins is the EASIEST and FASTEST way to purchase bitcoins.

Get $10 worth of free bitcoins when you buy $100 or more at Coinbase.

Which Countries Mine the most Bitcoins?

Bitcoin mining tends to gravitate towards countries with cheap electricity.

As Bitcoin mining is somewhat centralized, 10-15 mining companies have claimed the vast majority of network hash power.

With many of these companies in the same country, only a number of countries mine and export a significant amount of bitcoins.

China

China mines the most bitcoins and therefore ends up “exporting” the most bitcoins.

Electricity in China is very cheap and has allowed Chinese Bitcoin miners to gain a very large percentage of Bitcoin’s hash power.

It’s rumored that some Chinese power companies point their excess energy towards Bitcoin mining facilities so that no energy goes to waste.

China is home to many of the top Bitcoin mining companies:

F2Pool, AntPool, BTCC, and BW.

It’s estimated that these mining pools own somewhere around 60% of Bitcoins hash power, meaning they mine about 60% of all new bitcoins.

Georgia

Georgia is home to BitFury, one of the largest producers of Bitcoin mining hardware and chips. BitFury currently mines about 15% of all bitcoins.

Other Countries

The countries above mine about 80% of all bitcoins.

The rest of the hash power is spread across the rest of the world, often pointed at smaller mining pools like Slush (Czech Republic) and Eligius (US).

A Note on Pools

While we can see which mining pools are the largest, it’s important to understand that the hash power pointed towards a mining pool isn’t necessarily owned by the mining pool itself.

There are a few cases, like with BitFury and KnCMiner, where the company itself runs the mining operation but doesn’t run a mining pool.

Bitcoin miners can switch mining pools easily by routing their hash power to a different pool, so the market share of pools is constantly changing.

To make the list of top 10 miners, we looked at blocks found over the past 6 months using data from BlockTrail.com.

The size of mining pools is constantly changing. We will do our best to keep this posted up-to-date.

Note:

If you cloud mine then you don’t need to select a pool; the cloud mining company does this automatically.

Why are Miners Important?

Bitcoin miners are crucial to Bitcoin and its security. Without miners, Bitcoin would be vulnerable and easy to attack.

Get this:

Most Bitcoin users don’t mine.

However, miners are responsible for the creation of all new bitcoins and a fascinating part of the Bitcoin ecosystem.

Mining, once done on the average home computer, is now mostly done in large, specialized warehouses with massive amounts of mining hardware.

These warehouses usually direct their hashing power towards mining pools.

Payout Schemes

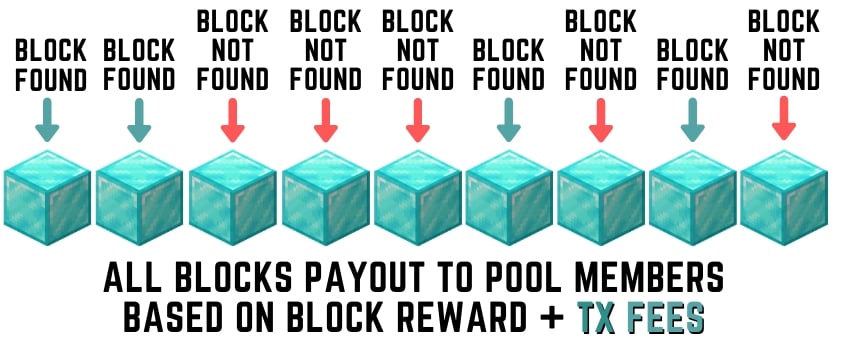

How do Pools Pay Members?

You may be wondering how pools payout their members?

Is it the same way everytime?

Do all pools use a similar payment structure or are all of them unique?

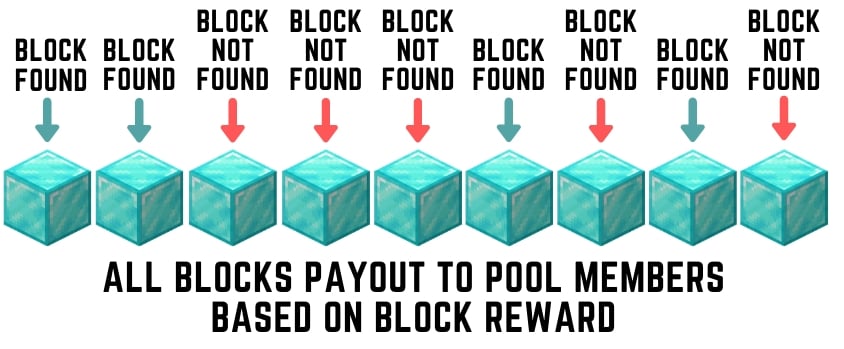

When you become a member of a mining pool, there are a number of ways your rewards for contributing hashing power can be calculated. All of the payout methods use the term “share”.

A "share" is awarded to members of the mining pool who present a valid partial proof-of-work.

Essentially, the more hashing power you contribute to the pool, the more shares you are entitled to.

Pay Per Share

The most simple payout scheme, Pay Per Share guarantees the miner a payout regardless of if the pool finds the next block or not. The value of a share is determined by the amount of hashing power that is likely needed to find a block divided by the reward for finding it.

If 100 shares are likely needed to find a block and the reward is 6.25 BTC, then each share is worth .0625 BTC (6.25 / 100).

Payment is paid from the pool’s existing balance and the amount of the payment is determined based on your number of shares.

Because payment is guaranteed, more of the risk is on the mining pool operator. The payouts to the pool members is therefore smaller than in Pay Per Last N Share, explained below.

One final feature of Pay Per Share is that transaction fees from each block are kept by the pool operator. Pool members are only paid based on block rewards.

Full Pay Per Share

Full Pay Per Share (also known as “Pay Per Share +”) is the same as Pay Per Share, except transaction fees are also paid to the pool members on top of the block reward.

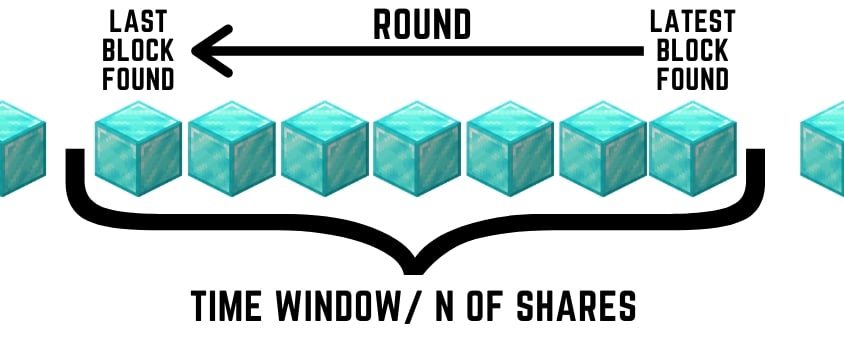

Pay Per Last N Shares

Pay Per Last N Shares is a more complicated payout that shifts more risk to pool members but also more rewards.

In Pay Per Last N Shares, pool members are only paid once a block has been found. Once a block is found, the pool looks at your share contributions for all previous blocks where the pool did not find the block, and this is called a “time window”. All the blocks in a time window are known as a “round”. Using these numbers, the pool determines your total share contributions over the round to determine your payout.

For example, if the pool mines through 6 blocks before finding a block, Then their reward for all the hashing power the pool contributed to the network over thsy 6 block round is 6.25 Bitcoins (not including transaction fees). If you contributed 100 shares for each of those blocks and the total number of shares was 1000, then your payment would be .625 BTC or .104 BTC per block.

The idea behind this payout scheme is that it removes all luck and only pays members based on their contribution to actual revenue earned by the pool. This scheme also incentivises members to continue mining on in the pool even as the profitability of mining different coins rises comparatively. This is because disconnecting from the pool before a block is found will pay you nothing.

Pools that use Pay Per Last N Share may or may not include transaction fees in their reward payouts so it is up to your to find this out from each pool.

Pool Overviews

What Makes Each Pool Unique?

So which pool should you choose?

Let's go over all the most important info of each of the pools.

By the end, you should be able to pick the best one for you.

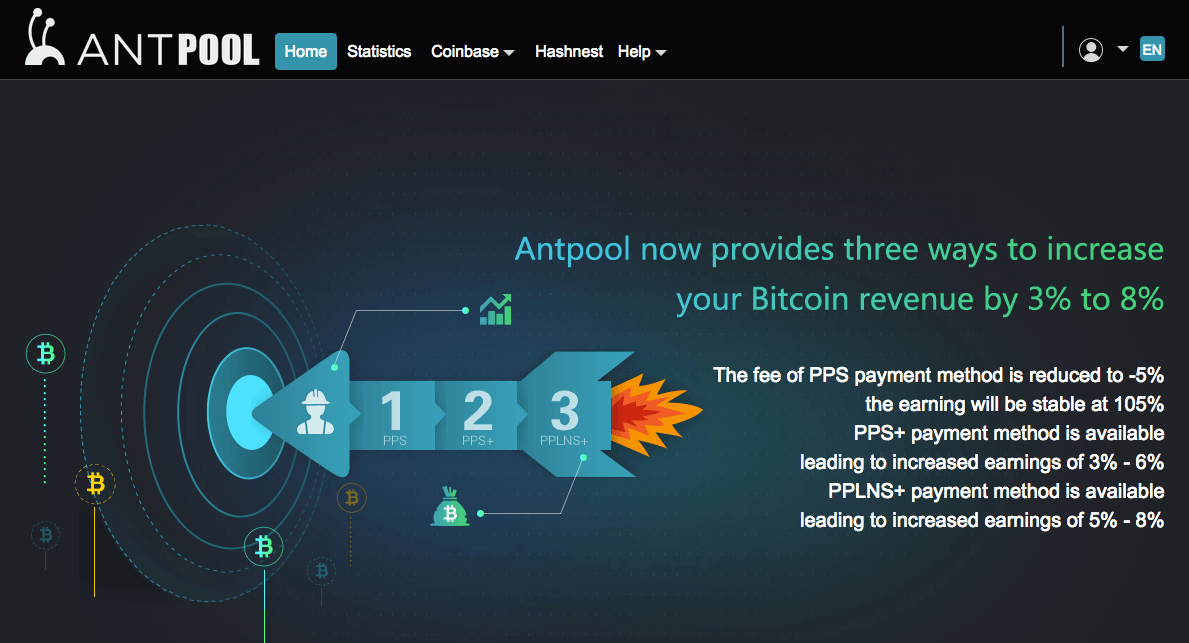

A Mining Pool By the Worlds Biggest ASIC Producer

Despite recent controversy, Antpool remains the largest Bitcoin mining pool in terms of its Bitcoin network hash rate. Antpool holds roughly 15% of the total hash rate of all Bitcoin mining pools.

About Antpool

Antpool mined its first block in March 2014, meaning that it emerged roughly four years after the first mining pool; Slushpool.

Antpool is run by Bitmain Technologies Ltd., the world’s largest Bitcoin mining hardware manufacturer, and a large portion of their pool is run on Bitmain’s own mining rigs.

Antpool supports p2pool and stratum mining modes with nodes that are spread all over the world to ensure stability (US, Germany, China etc.).

Also, Antpool’s user interface is surprisingly slick considering that the underlying company thrives mostly off of hardware sales.

How to Join Antpool

The pool is free to join and the process is simple.

First, you need to acquire Bitcoin mining hardware. Then you need to download mining software. If you need help deciding, I suggest you take a look at our hardware and software guides.

Hardware is important because it determines the size of your contribution to the pool’s hash rate. Software is important because it enables you to direct your hardware’s hash power towards the pool you prefer. So make sure to make the right choice in order to optimize your rewards.

Finally, sign up at antpool.com to get started.

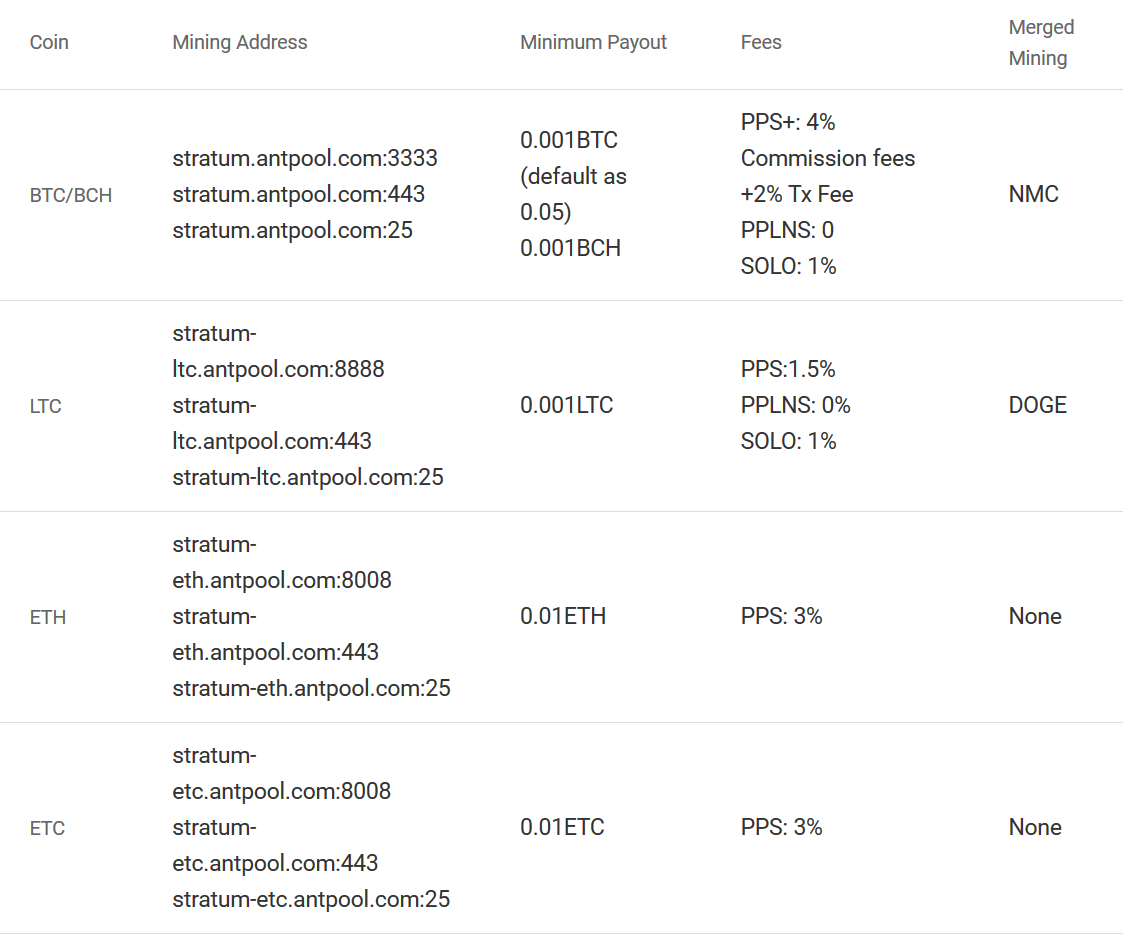

What are Antpool’s Fees?

Antpool’s payout structure and percentages vary wildly depending on the coin you are mining in the pool.

In the case of Bitcoin, you will be charged a PPS+ at 4% plus a 2% transaction fee or you can choose PPLNs at 0% or SOLO at 1%.

You can see below for more details:

While Antpool does not directly charge fees, it also does not disclose the Bitcoin transaction fees that are collected. Basically, clients are left in the dark. Currently, every Bitcoin block has a 12.5 BTC reward which Antpool does share with you when it finds a block.

Lately, however, Bitcoin transaction fees have been rising and an additional 1-2 bitcoins are collected per block by pools. At this time, Antpool keeps 1-2 bitcoins form transaction fees for itself, which are not shared with miners who have hash power pointed toward the pool.

It can be argued that these rates prevent the service from being usable for small-time and big-volume users. Consequently, some users on bitcointalk.org heed that the undisclosed fees make the service unwise to use for the time being.

What is the Payout Threshold?

The pool does not appear to have a payout threshold and pays out every day around 10 AM UTC.

The minimum withdrawal amount is 0.0005 BTC (other sources say 0.001 BTC).

What is the Controversy around Antpool?

Antpool had refused to enable arguably beneficial upgrades to Bitcoin for reasons that have been largely disproven.

More specifically, the controversy revolved around Segwit – a feature that required miner activation to be enabled. Despite the fact that most Bitcoin users wanted this feature activated, Antpool, among other pools, was attempting to block it.

This eventually resulted in the Bitcoin Cash hardfork and the ultimate activation of Segwit on Bitcoin.

A Private Pool with its Own Hardware

According to BlockTrail, Bitfury is the third largest Bitcoin mining pool and mines about 11% of all blocks.

The main difference between the Bitfury pool and other mining pools is that Bitfury is a private pool.

Bitfury, the company, makes its own mining hardware and runs its own pool. So, unlike Slush or Antpool, Bitfury cannot be joined if you run mining hardware at home.

Bitfury 16nm ASIC Chip

Unrelated to its pool, Bitfury sells a 16nm ASIC mining chip.

Although Bitfury controls a large portion of the Bitcoin network hash rate, its committed to making Bitcoin decentralized:

BitFury is fundamentally committed to being a responsible player in the Bitcoin community and we want to work with all integrated partners and resellers to make our unique technology widely available ensuring that the network remains decentralized and we move into the exahash era together.

Valery Vavilov, CEO of BitFury

The Very First Mining Pool

Slush Pool is a name you probably heard if you ever researched mining pools. Today, we’re going to help you familiarize yourself with it and see whether or not it’s worth using.

Slush Pool has been around since 2010 and is one of the oldest Bitcoin mining pools in existence. It was originally simply called “Bitcoin Pooled Mining Server” or BPMS for short.

Since the launch, the pool has had its ups and downs but things have been mostly positive recently.

Satoshi Labs run Slush Pool. You may also know Satoshi Labs from their work on Trezor, the first Bitcoin hardware wallet and Coinmap, a world map outlining which merchants accept Bitcoin. They also invented the scoring system, which awards users based on the “hash power” (the processing power) they bring to the mining pool.

Slush Pool was the very first mining pool, and, over the last decade, its users have mined more than 1 million Bitcoins using its services and software: BraiinsOS and BraiinsOS+.

And if that doesn’t sound impressive enough, you should also take this into consideration: in the last 6 months, Slush Pool collected more than 9% of all Bitcoins on the market.

That percentage makes it one of the five biggest Bitcoin mining pools on the Internet.

What Services does Slush Pool Offer?

We’ve covered what the Slush Pool is and explained how it works. Now let’s have a look at the specific services offered by Slush Pool should you decide to join it for your own mining efforts.

1. Fees and Payments

In terms of fees, Slush Pool is very similar to other mining pools on the market. They offer a standard 2% fee, which you share with other miners. There’s a 0.0002 Bitcoin threshold, which means once you reach this sum, the platform automatically sends the earnings to your account.

The best thing about the payments is Slush Pool’s famous score-based method of payments, which allows the awards to be distributed fairly among Bitcoin miners.

2. Customer Service

Customer support is at a high level. Of course, the users can send emails to the network officials if they have any problems. In most cases, a customer support agent will respond in less than 24 hours.

However, you can also talk to customer support agents instantly if you have an emergency problem. The company has a dedicated website, where you can start a conversation with customer support if you have questions about your mining setup, user account, or rewards.

3. Security

Security levels are more than satisfactory. You have 2-factor authentication and wallet address locking for emergency cases. You get a read-only token that allows you to log into your account, in case someone tries to hack your account or steal your identity.

You can also lock your address if someone else is monitoring your account while you’re mining. In addition to that, the company only uses highly-secured servers, which guarantee the safety of your Bitcoin wallets.

Slush Pool Pros and Cons

Now we’re going to give you a list of both positive and negative aspects of the world’s oldest mining pool.

You can just take a look at the positive and negative aspects and decide whether you should use the pool or not if you don’t have the time to read the entire review.

Slush Pool Pros

- It's the world's longest-running bitcoin mining pool

- The service has had hundreds of thousands of users over the last decade

- The interface is good-looking and easy to use for users of all knowledge levels

- It offers you score-based mining, which prevents you from being cheated by others

Slush Pool Cons

- The transaction fee is not lows as it is on other top websites

- Once you stop mining on this network, your user-score goes down quickly

Should You Use Slush Pool or Not?

In conclusion, is Slush Pool worth your time and effort? The short answer is yes, Slush Pool is a good choice if you want to start mining. It’s great for first-time users due to its simplicity. Plus, it gives awards to some of its most active users.

Quick Tip

Mining bitcoins? You can't without a Bitcoin wallet.

Our guide on the best bitcoin wallets will help you pick one. Read it here!

Long-time miners will also be satisfied. The service is always at the top of mining trends. The company officials never stand still, issuing constant updates that make their service fresh and up-to-date at all times.

In other words, you won’t go wrong if you pick Shush Pool as your mining pool. Keep in mind though that while Slush is the oldest pool, it is by no means the biggest or the cheapest, and keeping fees low is crucial for any mining operation.

An Innovative Mining Pool with Lots of Features

F2Pool was originally launched in 2013 in Beijing. Due to its popularity, it soon expanded to other continents.

The service is now available in Russia, Canada, and the United States, among other countries. Today, with 17.5% of the market in its control, F2Pool is the second-largest Bitcoin mining pool on the market.

And keep in mind, F2Pool could potentially become the biggest pool soon. Just for reference, Poolin, the biggest pool, holds only 0.7% more market share than F2Pool. And at 9%, Slush Pool, another of the biggest pools, controls just over half of what Poolin commands.

In addition to Bitcoin, F2Pool miners can also mine for Litecoin, Ethereum, and multiple other cryptocurrencies. All in all, you can mine for more than 40 cryptocurrencies in this pool.

Although the website was originally created just for the Chinese market, the company now has an English language version of its website and the interface is extremely easy to use for miners of all experience levels.

What Services does F2Pool Offer?

We’ve familiarized ourselves with the inner-workings of the company and talked about how F2Pool works. Now’s the time to talk about some of its main functions and services offered. For most people, the services offered are what makes or breaks a mining pool.

Fees and Payments

The biggest downside of F2Pool is their fee. Every transaction comes with a 4% fee, which is certainly not small. In fact, this is double what slush charges. However, many miners clearly fee the fees are worth it, given the size of the pool. Numbers don’t lie.

For instance, they offer daily payments and every time you reach 0.001 Bitcoin in your wallet, the company sends money to you automatically. They operate on a PPS system, which means they reward the people who mine the most on their network.

Customer Support

Having good support is crucial for both experienced and inexperienced users. You need to talk to a knowledgeable person if you have any doubts or questions about your account or payments.

Fortunately, anyone who’s had any experience with the F2Pool customer service knows that they are responsive and knowledgeable in their field. They guarantee a response to all inquiries in less than 24 hours. However, you can contact them instantly through their chat if you have a real emergency.

Security

F2Pool wouldn’t be so widely-used if they didn’t have good security. The website has the HTTPS protocol and the service comes with a wallet-lock feature, which protects your investment in case your account gets hijacked.

Just keep in mind that the email address you used to register can’t be replaced. The company forbids it for security reasons to prevent identity theft on their network.

F2Pool Pros and Cons

Now that you’re familiar with F2Pool’s history and some of its core features, we’re going to list all of its positive and negative aspects in place.

You can use this list to remind yourself about F2Pool’s pros and cons without reading the article if you start wondering whether you should use the service or not.

F2Pool Pros

- Almost a decade of experience for the F2Pool staff members

- The registration process is intuitive and the verification process is quick

- The pool allows its users to mine Bitcoin, Litecoin, and ZCash

- You have regular payouts and the threshold is quite low

F2Pool Cons

- The 4% fee is higher than any other pool out there

- Your account may be deactivated if it's left inactive for too long

Should You Use F2Pool or Not?

When it’s all said and done, what do we recommend? Should you use F2Pool or not? You already know that the answer is yes if you read the review carefully.

Not only is F2Pool one of the oldest mining pools still running, but it’s also one of the best on the market, 7 years after the initial launch.

The only downside to F2Pool is that they charge high fees relative to other mining pools.

However, considering the rewards and services offered, the fee is definitely worth it. After a few months of mining, once you start making a healthy profit, you probably won’t even pay attention to the fee.

The Largest Mining Pool on Earth

Poolin is a multi-currency mining pool that includes popular and profitable coins, including Bitcoin, Litecoin, Bitcoin Cash, and Zcoin.

It was started by the same founders of BTC.com, which was later acquired by Bitmain. It is a Chinese-based mining pool with many miners from China, but it is open to everyone around the world.

Poolin’s Features

This section will give an overview of some of Poolin’s features.

Quick Tip

Mining is not the fastest way to acquire bitcoins.

Buying bitcoin is the fastest way.

Poolin Smart Agent

Poolin has its own proprietary software that acts as a proxy between miners and the pool. It helps reduce network traffic and allows miners to sync their settings, create sub-accounts, and balance the electrical load. This feature is available for Bitcoin, Litecoin, and Zcash.

Pushtx

A so-called transaction accelerator designed to mitigate the congestion of unconfirmed transactions via “fee bumping”. It helps the Bitcoin network and provides supplemental income for miners within the pool.

Offline Keeper

Custom software to turn off the miners in case of a network blackout to prevent hardware damage and save electricity. Mining hardware used at full capacity is known to degrade at a more advanced pace, so this can help save your investment.

Miner Box

This is Poolin’s custom miner monitoring software that can change settings in batches. This is useful for larger-scale operations.

A Variety of Altcoins

While most miners prefer to mine a handful of the top coins, Poolin supports some experimental altcoins. This includes Ravencoin, DASH, and Decred (DCR).

Ethereum Mining

For those wanting to monetize their graphics cards, the pool also supports Ethereum mining. This requires separate hardware since ASIC miners are designed for Bitcoin and Bitcoin forks.

Merged Mining

As bonus income, mining Bitcoin, BCH, or BSV in merged mining mode will result in Vcash, Namecoin, and Dogecoin payouts. This won’t affect normal hash rates of primary Bitcoin mining.

Getblocktemplate Support

This is the new mining protocol for Bitcoin that supports decentralization, fewer limitations while using ASIC hardware, and allows miners to make their own blocks.

Hashrate Auto-Switch

Since BTC and BCH share the SHA256 same algorithm, it’s easy to switch between each coin when one is more profitable. This is useful due to the wild swings in price on crypto exchanges, and is beneficial if one overtakes the other.

Payout

They have a minimum payout of 0.001 Bitcoin, and mining fees and payouts scale between currencies. There is a 0 minimum payment if using a Bixin or Mixin wallet. Upon request, users may make manual withdrawals.

Poolin’s Fees

Bitcoin: 4% FPPS (Full Pay per share)

Bitcoin Cash: 4% FPPS

Bitcoin SV: 4% PPLNS (Pay per last n shares)

Litecoin: 3% PPS (Pay per share)

DASH: 2% PPS

Ethereum: 3% PPS

Zcash: 3% PPS

Who Runs Poolin?

Poolin was founded by Kevin Pan, Christopher Zhu, and Tianzhao Li, and is currently under Beijing Satoshi Smart Co., Ltd. They were the former owners and founders of BTC.com, but the company is now unrelated to Poolin’s current operations.

Where are Poolin’s Servers located?

Poolin hosts nodes using cloud servers, so there is variance in which server you will connect to. This is contrary to a centralized server approach, which would have poor worldwide latency and security.

For example, the main mining pool server is btc.ss.poolin.com, which resolves to an IP Address of: “47.252.92.116”. This is located in a data center in San Mateo, California and is hosted by Alibaba’s Cloud service.

Quick Tip

Using mining software is not the fastest way to get bitcoins.

Try an exchange below for the fastest way to get bitcoins.

Bits of Gold

Bits of Gold- Crypto exchange based in Tel Aviv

- Buy with card, cash or bank transfer

- Supports Bitcoin & Ethereum

Rain

Rain- Exchange for Saudi Arabi, Oman, Kuwait, Bahrin, UAE

- Rain is based in Middle East

- High buying limits

WazirX

WazirX- Crypto exchange based in India

- Deposit INR with IMPS & UPI

- Low fees and many coins

eToro

eToro- Start trading fast; high limits

- Easy way for newcomers to get bitcoins

- Your capital is at risk.

Luno

Luno- Best for Nigeria, South Africa, Indonesia, Malaysia

- East to use interface

- Trusted exchange

Coinbase

Coinbase- High liquidity and buying limits

- Easy way for newcomers to get bitcoins

- "Instant Buy" option available with debit card

Bitbuy

Bitbuy- Exchange based in Canada

- Very high buy and sell limits

- Supports Interac & wire

Coinberry

Coinberry- Crypto exchange based in Canada

- Very high buy and sell limits

- Supports credit & debit card, Interac, wire

Coinsquare

Coinsquare- Canada's largest cryptocurrency exchange

- Very high buy and sell limits

- Supports bank account, Interac, wire

Coinmama

Coinmama- Works in almost all countries

- Highest limits for buying bitcoins with a credit card

- Reliable and trusted broker

eToro

eToro- Supports Bitcoin, Ethereum & 15 other coins

- Start trading fast; high limits

- Your capital is at risk.

This ad promotes virtual cryptocurrency investing within the EU (by eToro Europe Ltd. and eToro UK Ltd.) & USA (by eToro USA LLC); which is highly volatile, unregulated in most EU countries, no EU protections & not supervised by the EU regulatory framework. Investments are subject to market risk, including the loss of principal.

Conclusion

Mining can be very profitable but only if you have the right software, choose the right pool, have the necessary ASIC mining hardware, and can find a great deal on power prices. Getting all of these right is extremily difficult and unless you plan on making this your job, you will likely not be competitive. Pools help make it a little easier to compete since smaller operations can ‘pool’ together, but its still very difficult if not impossible to make money on a small budget mining operation.

-

-