Next bitcoin futures contract expiration - many thanks

Managing Bitcoin Futures Expiration: Rolling Forward

FACTOID: Bitcoin futures at CME Group provide the following expiries: Nearest two (2) Decembers and nearest six (6) consecutive months. This allows traders to enjoy flexibility in matching their price expectations to a variety of time horizons.

The vast majority of futures trades made by speculators are offset before final expiration. Some traders might allow their positions to expire; and in the case of bitcoin futures, would expire to cash settlement according to the Bitcoin Reference Rate (BRR).

However, a small group of investors, mainly institutions such as pension funds, endowments and money managers, might wish to extend their positions beyond the contract expiration. The strategy that allows them to extend a futures contract from one expiration to the next is referred to as rolling the futures contract (or rolling forward). The transaction that effects this strategy is called a calendar spread.

Calendar Spreads

A calendar spread allows a trader to exit the expiring contract and into a deferred contract in a single trade. By doing a calendar spread, a trader’s bitcoin futures position can be extended by one month or more depending on which deferred contract he rolls into. Below is an illustration showing how investors can roll their Bitcoin futures forward using calendar spreads.

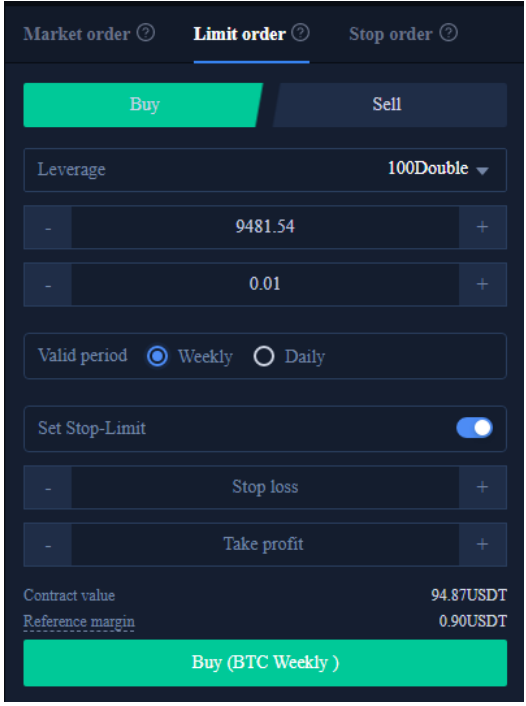

In Figure 1 below, you can see all the current Bitcoin futures contract expiration months.

Figure 1-Bitcoin futures price quotes: January 4,

A large investor is long 50 January Bitcoin futures (BTCF8) contracts. The portfolio manager for the fund wants to continue his long bitcoin exposure beyond the January expiration (last Friday of the contract month). He enters a calendar spread order to roll his contracts forward to the March expiry.

The FCM then enters a calendar spread order. A calendar spread order guarantees that the two transactions will be filled at the same time or not at all. Therefore, eliminating the possibility that the market moves away from you in the interim.

In the case of bitcoin, the investor’s FCM would sell 50 January futures (BTCF8) and simultaneously buy 50 March Bitcoin futures (BTCH8). With an existing long position in January Bitcoin futures, selling the January futures and buying March Bitcoin futures would result in an offsetting position, or net zero position, in January. This leaves the trader with a long position in 50 March contracts, giving an additional two months to profit should bitcoin continue to advance.

While the investor chose to roll into March futures, he could also have rolled into the February or June contracts depending on his time frame, relative pricing for each contract month, and outlook for the price of bitcoin.

Bitcoin Calendar Spread Convention

Certain futures contract spreads carry different quoting conventions; stock index futures and treasury futures have completely opposite conventions for buying and selling calendar spreads during the roll process. Bitcoin futures follow the same convention as stock index futures, in that buying the spread means buying the deferred contract and selling the nearby.

Hence, in the example above, where the pension investor buys the deferred futures (March) and sells the nearby (January), the investor is buying the calendar spread. The ticker convention would look as follows.

BTCF8 – BTCH8 is the Jan18/Mar 18 spread (buying the spread would be buying the March selling the January contract).

BTCH8 –BTCM8 is the Mar 18/Jun 18 spread (buying this spread would be buying the June and selling the March contract).

The price of the spread trade is the price of the deferred expiration minus the price of the nearby expiration. After the spread trade is done, the price of the two contracts will be determined using the following convention:

Priced to the nearby contract’s assigned price plus the spread price.

Example:

Bought BTCF8—BTCH8 @ +

Assuming BTCF8 prior settle = 14,

Price of the two legs: sold BTCF8 @14,, bought BTCH8 @ 14, + () = 15,

The spread price can also be negative, meaning that the March contract has a lower price than the January contract in this example.

Other Considerations

As of early January , each deferred futures contract in Bitcoin futures trades at successively higher prices (known as Contango). Hence the spreads are positive as of now. But this could change at any time. In fact, they could go negative. As you may be aware, spot bitcoin pays no dividends or interest. Moreover, while spot bitcoin is, for all intents and purposes, nearly impossible to sell short, it is relatively easy to sell short Bitcoin futures contracts. Given that no wallet risk exists with futures (you do not need a wallet when you trade futures but do when you buy bitcoin on the spot market). These factors will influence how futures in deferred calendar months will be priced. In a higher interest rate environment, it’s likely the spread will become more positive. In a severe bear market environment, the spreads could go negative and deferred contracts could become much cheaper than the nearby.

Given that Bitcoin futures are new a carry relatively high volatility, it behooves investors large and small to be aware of these nuances.

0 thoughts to “Next bitcoin futures contract expiration”