Consider, that: Btc tax calculator

| Btc tax calculator | 847 |

| BITCOIN MINING CPU USAGE | |

| BITCOIN MINING DAUER | 355 |

| LITECOIN BITCOIN CONVERTER |

🧮 Best Bitcoin Tax Calculator in the UK

Why would you need a Bitcoin tax calculator? If you have any cryptocurrency that you decided to get rid of (sell, present, donate, etc.) you will need to pay a tax. Since capital gains and losses rules apply when you dispose of your cryptocurrency.

HMRC explains that disposals include:

- selling cryptocurrency for cash

- exchanging cryptocurrency for a different type of cryptocurrency

- using cryptocurrency to pay for goods or services

- giving away cryptocurrency to another person

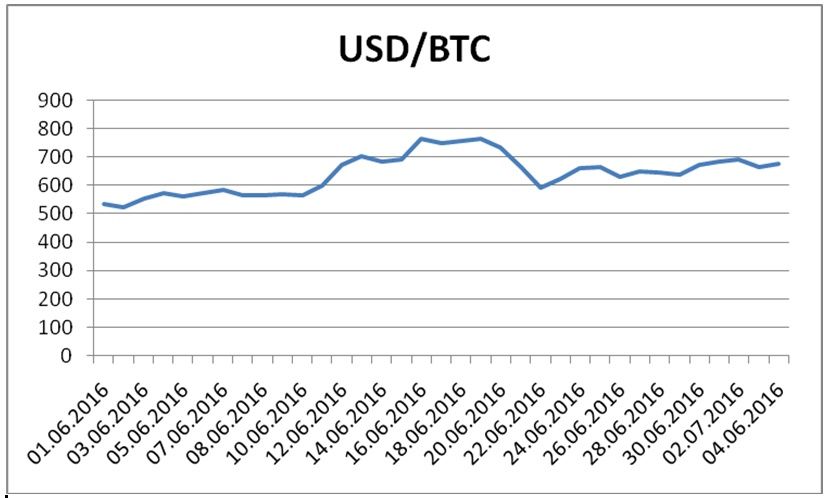

And calculating those crypto taxes can be really tricky as they are calculated based on the capital gains or losses from your digital asset holdings of coins like bitcoin. You are taxed on the value your crypto gains between when you acquire it and when you sell or exchange it.

What does it mean? It means that you need to keep a full record of your every transaction in order to do the right math.

On the other hand, you can use one of the crypto tax calculators that will do ‘all the dirty work’ for you.

How to handle your crypto tax?

To accurately calculate your tax liability, you will need to track your tax lots.

What are those lots? Tax lots entail the cost basis (the amount you originally paid for the crypto), the time held, and the price at which you sold the crypto. The cryptocurrency tax calculator handles this automatically, using your investment and trading history.

You’ll need your transaction history in order to track your tax lots. Additionally, for each sale or exchange, you will need the following information:

- Amount and currency of the coin or token sold

- Fiat value at the time of acquisition

- Date of acquisition

- Fiat value at the time of trade or sale

- Date of sale

It is very important to keep detailed records because trades are challenging to backfill, and any missing cost basis increases your tax liability.

You can back-fill missing data from receipts and exchange transaction confirmation emails, but it is much simpler to back up your information from exchanges regularly. Keeping notes on special situations, such as lost coins and ICOs, will also help you fill out your tax forms.

How to use a crypto tax calculator?

It is a piece of software that you link with your exchange and it will aggregate your data and then automatically linking your cost bases to your sales. They calculate your gains or losses and automatically populate tax reports with your data.

Best crypto tax calculators to use in the UK

TaxScouts

TaxScouts is a team of accountants who can help you file your tax form for just £ This is a local company that knows all ins and outs in order to stick to all the regulations we have in our kingdom.

Their website is full of helpful information including free online calculators for income tax and Capital Gain Tax.

How does it work?

- Register your account

- Answer a questionnaire

- Provide the required documents

- Your self-assessment will be filed for you

It usually takes two days from the point where their accountant has all the necessary documents to file your form.

One thing to keep in mind: if this is your first Self Assessment you’ll need to register and get a UTR number first. HMRC can take a few weeks to send it by post – so you should register early.

Koinly

Koinly is a popular platform with a crypto tax calculator, available in over 20 countries, including the UK. It helps you calculate your capital gains using Share Pooling in accordance with HMRC's guidelines.

The platform is also to start using Koinly’s crypto tax calculator. “Start for free, pay only when you are ready to generate your reports,” its website states. To generate tax reports for filing, Koinly offers four plans costing 0$, $49, $99, and $

How to use it?

In order to use Koinly’s tax calculator, you need to import your data from crypto exchanges, wallets, or public addresses. You can then review your transactions and generate your tax reports, which include capital gains, income and gifts, margin trades, options and futures trades, and audit logs. You can then export your transactions to tax filing platforms such as Turbotax, Taxact, and Xero.

Recap

Recap supports the UK and uses HMRC’s rules relating to cryptocurrency taxation. Launched in , Recap started out as the solution to our two co-founders who shared crypto tax headaches.

Their team is made up of experienced cryptocurrency specialists, all of whom are committed to security and success.

The platform also comes with a free plan with up to unlimited transactions to track your portfolio. However, you will need a paid plan to generate your tax reports.

Tokentax

Tokentax is more than just a calculator. The platform specializes in all kinds of taxes. Even though their primary market is the US, they also support clients from 18 countries including the UK. It is the leading crypto tax platform and cryptocurrency tax accounting company.

They are the first crypto tax software, whether by API or spreadsheet/CSV import. If their system doesn’t already support an import because an exchange is new or obscure, you can still upload the file and they will handle it manually — no extra work or charges or fiddling with manual templates necessary.

The company also provides several pricing plans with a different set of features to select from.

Here is a step-by-step guide

- Import all your cryptocurrency exchange trade history, as well as any transactions, made off-exchange.

- Verify that all historical data has been imported and that your crypto taxes are calculated properly.

- Decide on an accounting method.

- Export your tax forms.

- Include your crypto taxes on your return!

tallerembajador.com.mx

tallerembajador.com.mx has launched its full tax preparation service that is available since the tax year. And the good news that it also supports clients from the UK.

In partnership with tax attorneys, CPAs, and enrolled agents, users of the tallerembajador.com.mx platform can get tax preparation, advice, and planning with a tax professional to complete and file their tax returns.

What are their services?

- Understand crypto and be able to discuss it with you

- Assist in entering crypto trades into tallerembajador.com.mx

- Assist in tracking and reporting missing or lost records

- Reconcile unmatched transactions

- Provide full-service tax preparation for all tax forms

- Provide tax planning and strategies to identify crypto and non-crypto savings

- Provide advice for wash-sales, airdrops, staking, margin trading, and other complex crypto transactions

How does it work?

Simply import details of any crypto-currencies you have bought or sold from one of the supported trading exchanges, add any spending or donations you might have made from your wallets, any mined coins, or income you have received. And the rest will be done for you.

You will get:

- An Capital Gains Report detailing every transaction's cost basis, sale proceeds, and gain.

- An Income Report with all the calculated mined values.

- A Donation Report with cost basis information for gifts and tips.

- A Margin Report showing gross profits from margin trading (Kraken only).

- And your Closing Report with your net profit and loss and cost basis going forward.

BittyTax

BittyTax is a collection of open-source tools for calculating crypto asset taxes in the UK. Its main benefits are retaining user privacy and calculations made for free. The tool consists of three components including an accounting, conversion, and price tool. The tool will run smoothly on any computer with Python or 3.x installed.

- Set up the software on your computer.

- Export and make a record of all your transactions in an Excel or CSV file.

- Enter the file to the software and generate your report.

The accuracy of the report depends entirely on the data provided. Every report is split into 4 sections including Audit, Tax report per year, and 2 appendixes: Price Data and Current Holdings. It has the feature of removing duplicates, supports several output formats, and provides the latest and historic prices of crypto assets and foreign currencies.

Mycryptotax

Mycryptotax will take care of all dealings with HMRC, and relief you of the hassle, and save you valuable time.

This platform helps its clients understand Cryptocurrency tax implications in the United Kingdom and works to take the uncertainty out of compliance and tax reporting to HMRC.

How does it work?

- Book a free crypto tax review consultation

- Fill in the form and provide the required documents

- Your tax form will be filed for you.

They also come with 4 different pricing plans to choose from.

Summary

Under HMRC rules, taxpayers who do not disclose gains could face a 20% capital gains tax plus any interest and penalties of up to % of any taxes due. Those found to have evaded the tax could also face criminal charges and jail terms.

In order not to get in a situation like that, you should be very careful when filing your self-assessment. If you are not sure about some numbers, it is better and cheaper to hire a professional to help you out rather than ending up paying a fine.

-