Bitcoin the new gold? Analysts see times upside by Dec

Bitcoin, the world’s best-known cryptocurrency, is again buzzing among investors communitydue to the robust return it has delivered so far in Market watchers believe the ongoing rally will continue and investors should increase exposure as and when it sees any pullback.

A leaked report from Citibank, titled ‘Bitcoin: 21st Century Gold’ said the price of the bitcoincould hit the $3,18, mark by December This will mean a times growth from the current level of around $17,

The digital currencyhas already gained nearly per cent year to date from the December 31 close of $7, Earlier, the currency had scaled a record high of $19, on December 17, In rupee terms, it has soared per cent in to trade at Rs 13,76,

“The price action has been much more symmetrical over the past seven years or so, forming what looks like a very well-defined channel and this gives us an upside similar to the last rally. Such an argument would suggest this move could potentially peak in December at the high point of the channel, suggesting a move to as high as $k,” the report said. “Only time will tell if we end up at such lofty levels, but the backdrop and the price action clearly suggest the potential for a major move on the upside in next months,” it said.

Indian cryptocurrency watchers believe the ongoing rally is more sustainable compared with the previous ones. Sathvik Vishwanath, CEO of Unocoin, said: “That time (), the price increase was related more to the fear of missing out (Fomo) among investors. But this time, there are more genuine reasons for the price increase, like US hedge funds adding crypto assets to their balance sheets, PayPal allowing access to millions of its customers to buy and sell cryptos and DBS Bankdrawing up plans to provide trading services in crypto to its clients. It looks like the growth we are seeing now is more sustainable and the global recession and pandemic are fuelling it.”

The currency had tanked 73 per cent in after witnessing an euphoric 1, per cent rise in the previous year.

Global attitudes are also softening towards the use of crypto assets. For instance, the International Monetary Fund(IMF) released a video explainer on cryptos in August with a neutral approach to the subject.

Jefferies’ Global and Asia Equity Strategist Chris Wood in his weekly newsletter titled Greed & Fear said investors who do not own bitcoin should buy now and take exposure to it on the next dramatic pullback.

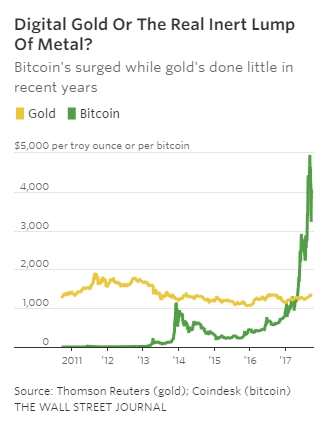

The Citibank report called bitcoin the new gold. “It is an asset with limited supply. It is digital. It moves across borders easily and the ownership is opaque,” it said.

“Gold and bitcoin are not mutually exclusive. But what has become very clear is that bitcoin has been massively outperforming gold as a hedge against G7 central banks’ balance sheet expansion. There are now custodial arrangements in place to own bitcoin, which makes institutional ownership of the asset class possible. The SEC-approved Bitcoin ETFs are surely coming sooner or later, as central banks formally embrace digital currencies, something the People’s Bank of China has already done,” Wood said.

A leaked report from Citibank, titled ‘Bitcoin: 21st Century Gold’ said the price of the bitcoincould hit the $3,18, mark by December This will mean a times growth from the current level of around $17,

The digital currencyhas already gained nearly per cent year to date from the December 31 close of $7, Earlier, the currency had scaled a record high of $19, on December 17, In rupee terms, it has soared per cent in to trade at Rs 13,76,

“The price action has been much more symmetrical over the past seven years or so, forming what looks like a very well-defined channel and this gives us an upside similar to the last rally. Such an argument would suggest this move could potentially peak in December at the high point of the channel, suggesting a move to as high as $k,” the report said. “Only time will tell if we end up at such lofty levels, but the backdrop and the price action clearly suggest the potential for a major move on the upside in next months,” it said.

Indian cryptocurrency watchers believe the ongoing rally is more sustainable compared with the previous ones. Sathvik Vishwanath, CEO of Unocoin, said: “That time (), the price increase was related more to the fear of missing out (Fomo) among investors. But this time, there are more genuine reasons for the price increase, like US hedge funds adding crypto assets to their balance sheets, PayPal allowing access to millions of its customers to buy and sell cryptos and DBS Bankdrawing up plans to provide trading services in crypto to its clients. It looks like the growth we are seeing now is more sustainable and the global recession and pandemic are fuelling it.”

The currency had tanked 73 per cent in after witnessing an euphoric 1, per cent rise in the previous year.

Global attitudes are also softening towards the use of crypto assets. For instance, the International Monetary Fund(IMF) released a video explainer on cryptos in August with a neutral approach to the subject.

Jefferies’ Global and Asia Equity Strategist Chris Wood in his weekly newsletter titled Greed & Fear said investors who do not own bitcoin should buy now and take exposure to it on the next dramatic pullback.

The Citibank report called bitcoin the new gold. “It is an asset with limited supply. It is digital. It moves across borders easily and the ownership is opaque,” it said.

“Gold and bitcoin are not mutually exclusive. But what has become very clear is that bitcoin has been massively outperforming gold as a hedge against G7 central banks’ balance sheet expansion. There are now custodial arrangements in place to own bitcoin, which makes institutional ownership of the asset class possible. The SEC-approved Bitcoin ETFs are surely coming sooner or later, as central banks formally embrace digital currencies, something the People’s Bank of China has already done,” Wood said.

2 Comments on this Story

Ajay Hooda48 days ago Buy Ballarpur Industries the next CG Power | |

Shri 49 days ago Bitcoin is shitcoin. falthu nonsense. dump fully |

0 thoughts to “Gold or bitcoin 2017”