World Economic Situation And Prospects: November 2017 Briefing, No. 108

13 November 2017- Rapid growth in cryptocurrencies posing a challenge for policymakers

- European Central Bank maintains accommodative policy stance while the Bank of England raises its key policy rate for the first time in more than a decade

- India announces plans to recapitalize State-owned banks

Global issues

Challenges of cryptocurrencies for policymakers

Over the span of less than a decade, cryptocurrencies have grown from a mere internet curiosity into a new multibillion-dollar asset class. In late 2008, Satoshi Nakamoto introduced the concept of blockchains and a store of value called Bitcoin. Since then, over 1,000 types of cryptocurrencies have been created. The ten most valuable coins represent around 90 per cent of the total market with around $175 billion in total capitalization. The leading cryptocurrency, Bitcoin, is valued at over $100 billion and has daily transaction volumes of more than $3 billion—more than nearly all of the other coins combined. Since its creation, the value of one Bitcoin has climbed rapidly from around $0.01 in 2009 to reach over $7,000 (figure 1).

The rise in popularity and value of Bitcoin and other cryptocurrencies has brought them under scrutiny from governments and central banks worldwide. Regulators are struggling to understand the potential economic impact of cryptocurrencies, their implications for monetary policy, and options for regulating this new asset. On this last point, there is still an ongoing debate over how cryptocurrencies should be regulated, or if they should be regulated at all.

There exist both similarities and differences between cryptocurrencies and “fiat” money. Perhaps one of the most important differences is that, cryptocurrencies are not under the control of monetary authorities, and their degree of recognition and regulation varies widely across countries. Although cryptocurrencies do not have a national legal tender status and do not exist in physical form they are increasingly being used as a mode of payment, and, despite their high volatility, as a store of value.

Cryptocurrencies have some unique characteristics. Their supply is generally governed by a specific set of rules, which are independent from political influence and actions of monetary authorities. In the case of Bitcoin, the rules and cryptography are determined by a system of governance rooted in voluntarism and consensus of users, which replace the need for a single trusted counterparty. As another key characteristic, the blockchain technology underpinning cryptocurrencies is highly resistant to counterfeiting. The system prevents arbitrary addition to the supply and the double spending of coins, and transactions cannot be repudiated or undone. The state of the blockchain and every change to it are verifiable by every user.

These characteristics add to the appeal of cryptocurrencies, but may entail several economic risks and create considerable challenges for policymakers, especially since cryptocurrencies still fall outside the purview of monetary authorities in most countries.

Amid growing interest from the public, cryptocurrencies are increasingly perceived as investment opportunities. They are particularly attractive in high inflationary environments, which has encouraged an expanded use of digital currencies in countries such as the Bolivarian Republic of Venezuela. The rapidly growing price of digital currencies, without a sound valuation method underpinning this price, raises concerns about a mismatch between the perceived and actual levels of risk associated with cryptocurrencies, and the potential formation of price bubbles.

Valuation of digital currencies might seem straightforward, as the price is determined directly by supply and demand in the market. However, digital currencies lack any form of underlying fundamentals to guide the market-determined price. “Traditional” asset classes, such as stocks or bonds, can be valued based on the cash flows that they generate. The profits that a company is expected to generate underpin the price of its shares. Commodities are linked to their cost of mining, and available supply, and the demand for their use as inputs into final products. In a similar way, real estate prices are guided by supply and demand of housing, as well as the cash flow of rents. Finally, currency prices can be linked to the value of produced goods and balance of payment positions of particular countries. In contrast, the valuation of a cryptocurrency cannot be grounded in such underlying fundamentals. Supply of digital currencies rises very slowly, restricted by the governing set of rules as well as available hardware and energy supplies, so that prices are determined largely from the demand side. This leaves the valuation prone to sudden changes and high volatility.

Another key area of concern is the possible misuse of cryptocurrencies for tax evasion, money laundering, and funding of illegal activities, given their ability to bypass formal banking networks and cross-border capital flow controls.

While there are still no widely-agreed policies governing cryptocurrencies, many governments have started to introduce national regulations related to taxation, money laundering and other similar issues. The United States of America and the European Central Bank began accepting cryptocurrencies as virtual currencies a few years ago. More recently, the Islamic Republic of Iran had started preparations for widening their use as one of the legal payment methods. In Ukraine, recently introduced draft legislation defines cryptocurrencies as legal property, which can be exchanged for goods and services, and suggests taxing them. The legislation also addresses cryptocurrency mining—a computing-intensive process creating new digital currency units—stating that the gains are also subject to taxes. By mid-2018, the Russian Federation is expected to adopt legislation determining the status of cryptocurrencies. In contrast, serious restrictions have been imposed on cryptocurrencies in China. At the same time, both China and the Russian Federation are exploring the possibilities of issuing their own sovereign digital currencies.

It remains unclear whether cryptocurrencies in their current form will continue to grow at such a rapid pace going forward. Nevertheless, the potential development of new sovereign digital currencies, continuous evolution of the existing digital currencies, and the rapidly growing application of the blockchain technology in other areas, suggests that the use of cryptocurrencies will continue to expand. While cryptocurrencies still account for only a tiny fraction of global monetary transactions, the policy implications will need to be carefully monitored as they beome more widely used. If they were to eventually reach a scale that impacts demand for national currencies, this could impact the level of domestic deposits at commercial banks, and ultimately central bank balance sheets and the transmission of monetary policy.

Developed economies

United States: Steady growth but limited spillovers to the rest of the world

According to the advance estimate, gross domestic product (GDP) in the United States expanded at an annualized rate of 3 per cent in the third quarter of 2017, and remains on track to record growth of 2.2 per cent for the year as a whole. Household spending continues to make a steady contribution to growth, but has outpaced income growth by a significant margin since 2016. Consequently, the household savings rate has fallen to its lowest level since the period leading up to the global financial crisis, when consumption was fuelled by excessive optimism and overinflated asset prices. Without a stronger rise in real income, household spending is likely to moderate over the coming quarters. This moderation will be partially offset by a slightly more expansionary fiscal stance. The budget for 2018 is still under negotiation, but is likely to include a steep cut to the top corporate tax rate, from 35 per cent to 20 per cent. Total budgetary changes will remain within an envelope that allows the deficit to increase by not more than a cumulative $1.5 trillion over 10 years, or approximately 0.6 per cent of GDP. Policy changes are expected to add roughly 0.1 percentage points to GDP growth in 2018. The distributional impact of these changes will depend crucially on details agreed in the final budget.

Import volumes contracted in the third quarter, limiting the extent to which robust growth in the United States signals stronger growth in the rest of the world. Given the relative strength of domestic demand, the decline in imports comes as a surprise, and may in part be related to uncertainties related to current trading arrangements or anticipated changes in trade policy, which may induce some firms to source intermediate goods from domestic, instead of foreign, producers. This is consistent with the steep build-up of private sector inventories, which added 0.7 percentage points to GDP growth in the third quarter.

Europe: The ECB makes a dovish policy announcement while the BoE tightens its policy stance

In October, the European Central Bank (ECB) announced that it would reduce its monthly asset purchases by half to €30 billion from January 2018. These asset purchases will last at least until September 2018, dependent on inflation moving closer to the ECB’s policy target of slightly below 2 per cent. The ECB also announced that it will reinvest maturing principals from its asset purchases for an extended period of time after ending its net asset purchases. The ECB left interest rates unchanged and reiterated their commitment to maintain rates at current levels for an extended period and well past the end of the asset purchase programme. Taken together, this represents a more accommodative stance by the ECB than earlier expected, as reflected in the decline of the euro against the dollar following the announcement. The ECB has essentially left its asset purchase programme open-ended and moved the prospect of any increase in interest rates even further into the future. Meanwhile, the Bank of England (BoE) raised interest rates by 25 basis points to 0.5 per cent and indicated the possibility of two more interest rate hikes over the next three years. Inflation is running above the BoE’s policy target, driven in part by the pound’s depreciation in the aftermath of the United Kingdom of Great Britain and Northern Ireland’s referendum to leave the European Union (EU).

Among the new EU members, the Czech National Bank (CNB) raised its key policy rate by 25 basis points to 0.5 per cent in early November. This was the CNB’s second rate hike this year, as rapid wage growth of over 7 per cent and record low unemployment (also the lowest in the EU) fuelled higher demand-pull inflationary pressures. In September, inflation rose to 2.7 per cent, above the official 2 per cent target. Among the other Eastern European countries, inflationary pressures have also emerged and are expected to persist in the coming quarters. Nevertheless, as the ECB continues its asset purchases, stronger demand for the Czech currency should drive yields and interbank market rates up, alleviating the need for further monetary tightening in the near-term.

Economies in transition

CIS: Reversal of monetary loosening in Ukraine

As anticipated by financial markets, the Central Bank of the Russian Federation continued to cautiously ease monetary policy, reducing its key policy rate by 25 basis points to 8.25 per cent in October. Inflation dipped to below 3 per cent in October, despite expanding consumer credit, recovering private consumption and imports, and 3 per cent retail sales growth in September, thanks to the ample harvest and stronger currency. The economy is on track to reach 2 per cent growth in 2017. However, the strongest contribution to growth in the first half of 2017 was provided by the extraction industry, underscoring the economy’s continuing dependency on the commodity sector.

In October, monetary policy was also relaxed in Belarus and the Republic of Moldova, but had to be reversed in Ukraine, where agricultural output contracted in 2017 owing to unfavourable weather conditions and relatively higher global food prices spurring exports of agricultural products, limiting the availability for domestic consumption. Prices for some products, such as meat, have increased by over 40 per cent. Along with the currency depreciation, this pushed inflation up to 16 per cent in September. In late October, the National Bank of Ukraine raised its policy rate for the first time since 2015.

In Central Asia, Uzbekistan reported much slower economic growth in the period January–September 2017 than in the previous ten years, at 5.3 per cent. The reported slowdown may in fact reflect an improvement in the statistical accounting framework, rather than a slowdown in economic activity. Recent improvements in public administration, coupled with steps towards currency and capital account liberalization, may also facilitate increased funding from development banks and stronger foreign direct investment (FDI) inflows.

In South-Eastern Europe, flash estimates showed that the economy of Serbia expanded by 2.1 per cent in the third quarter, following a sluggish first half of 2017 related to a harsh winter followed by drought.

Developing economies

Africa: More countries turned to easing monetary stances

Decreasing inflationary pressures and improving foreign exchange conditions opened a window for several central banks in Africa to shift their stance to easing in order to promote private sector credit growth. In October, three central banks in Africa eased their monetary stance. The Bank of Botswana and the Bank of Mozambique both reduced their key policy rates by 50 basis points to 5 per cent and 22 per cent, respectively. Meanwhile, the Bank of Uganda also cut its key lending rate by 50 basis points to 9.5 per cent. Since the start of 2017, central banks in the Gambia, Ghana, Malawi, Mauritius, Namibia, Rwanda, South Africa, United Republic ofTanzania, and Zambia have also shifted the monetary stance to easing, despite interest rate rises by the United States Federal Reserve. Nevertheless, a majority of African economies still cannot afford to take an accommodative monetary policy stance due to foreign exchange constraints. Most recently, the National Bank of Ethiopia raised its policy rate to 7 per cent from 5 per cent. Central banks in the Democratic Republic of Congo, Egypt, Tunisia, and the Bank of Central African States, which serves the member countries of Central African Economic and Monetary Community (CEMAC)[1], have also tightened the monetary stance in 2017. Despite gradually improving economic prospects, African economies are still prone to shocks through the international capital markets, partly owing to the low levels of foreign reserves, which can function as a buffer against financial shocks. Therefore, unless foreign reserves recover to sufficient levels to cast off this vulnerability, many central banks in Africa are expected to maintain tight monetary stances.

[1] Cameroon, Central African Republic, Chad, Equatorial Guinea, Gabon, Republic of Congo

East Asia: Robust third quarter growth in several economies

Third quarter GDP growth figures in a few major East Asian countries reflected continued robust expansion of economic activity in the region. In China, growth remained solid, underpinned by favourable domestic demand and accommodative fiscal measures. The growth momentum, however, moderated slightly to 6.8 per cent on a year-on-year basis, as the continued slowdown in industrial and construction activity more than offset stronger services growth. Looking ahead, the Chinese economy is projected to remain on a gradual growth moderation path, as measures to curb financial risks weigh on the real estate and financial sectors.

Meanwhile, growth in the Republic of Korea, Singapore and Taiwan Province of China reached multi-year highs in the third quarter. The growth improvement in these economies continue to be largely driven by strong global demand for electronic products, which is likely to extend into the last quarter of 2017. Despite elevated geopolitical tensions on the Korean Peninsula, growth in the Republic of Korea accelerated to a 7-year high of 3.6 per cent. Growth in the economy was also boosted by an increase in fiscal spending during the quarter, as the Government rolled out its supplementary budget. Meanwhile, Singapore’s strong growth of 4.6 per cent was attributed to double-digit growth in manufacturing output, particularly in the biomedical, pharmaceuticals and medical technology sectors. In Taiwan Province of China, GDP expanded by 3.1 per cent, as export growth benefitted from the launch of new consumer electronic products. The strong external sector performance of the economy, however was partially offset by a decline in domestic investment during the quarter.

South Asia: India’s Government announces recapitalization plan for state-owned banks

In October, India’s Government announced a $32 billion recapitalization plan for State-owned banks—which accounts for about two-thirds of banking assets—to tackle their persistent financial vulnerabilities, including relatively elevated levels of non-performing loans. Official data shows that non-performing loans in State-owned banks have risen from 5.4 per cent in 2015 to about 14 per cent in 2017, amid increasing defaults in the manufacturing and infrastructure sectors. The objective of the recapitalization package is to strengthen banks’ balance sheets and thus support credit growth, especially to small and medium-sized firms, as investment performance remains largely subdued. Furthermore, weak investment demand has become a crucial macroeconomic concern in the Indian economy, not only because of its short-term implications on growth but also its medium-term impact on productivity and sustainable development. Gross fixed capital formation as a share of GDP has declined from about 40 per cent in 2010 to less than 30 per cent in 2017. While several details of the plan need to be clarified, the capital injection would be mostly for bad-loan provisioning, and it will be financed by a combination of bonds issuance, market-based fundraising and public budgetary resources. While this recapitalization plan is a positive development on the supply side, its real impact on credit growth and investment demand remains to be seen. In fact, the lack of demand for credit from corporate sectors is likely to remain a constraint to investment, at least in the short term.

Western Asia: Syrian pound appreciated while central bank remains cautious

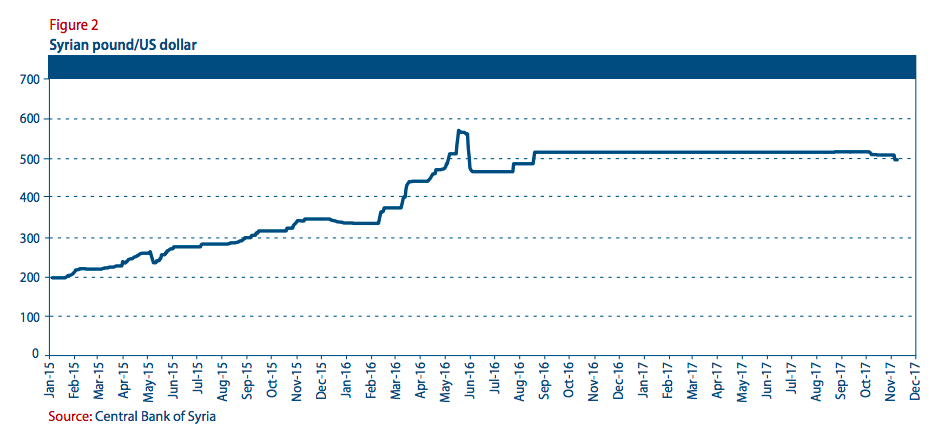

The Central Bank of Syria has gradually raised the official value of the national currency, the Syrian pound (SYP), since mid-October. After a substantial depreciation of the Syrian pound in the first half of 2016, the exchange rate had been stabilized at a narrow range around SYP 517.43/$ over the past 15 months (see Figure 2). Following the revaluations, the official exchange rate stood at SYP 498/$ on 5 November. The central bank’s move came with a set of directives to limit the level of foreign currency remittances that individuals can convert to pound per month. By the directive of 28 October 2017, in principle, an individual is only allowed to purchase the Syrian pound up to the equivalent value of $500 once a month. As the purchase restriction came into effect, the value of the Syrian pound in the black market appreciated to SYP 480/$, beyond that of the official rate. The cautious step taken by the central bank indicates its concerns over a rapid currency appreciation, rather than depreciation, which could hamper domestic liquidity management. Consumer price inflation in Syria is expected to decline significantly over 2017 and 2018 in response to the exchange rate stabilization.

Latin America and the Caribbean: South America’s monetary easing cycle continues amid declining inflation

The economic recovery in South America is slowly gaining traction. However, the strengthening of domestic demand has yet to generate substantial price pressures. In many countries, consumer price inflation hit multi-year lows, weighed down by declining food prices and continued economic slack. In Brazil, inflation declined to an 18-year low of 2.5 per cent in September, following a record harvest as well as weak wage growth, amid double-digit unemployment. In Chile, inflation slowed to 1.5 per cent in September, the lowest rate since 2013. In both countries, the current level of inflation is well below the central bank target, which ranges from 3–6 per cent in Brazil and from 2–4 per cent in Chile. Consumer price inflation has also fallen considerably in Colombia (to about 4 per cent), in Peru (to about 3 per cent) and in Ecuador (to about 0 per cent). The steady decline in inflation, coupled with relatively stable currencies, has allowed central banks to further ease monetary policy. In Brazil, the central bank has aggressively lowered interest rates in a bid to support the still fragile economic recovery. In September and October, the main policy rate was reduced by a total of 175 basis points to 7.5 per cent, compared to 14.25 per cent in October 2016. The central banks in Colombia and Peru also reduced their policy rates in recent months, whereas the central bank in Chile reopened the possibility of further rate cuts after previously signaling an end to the current easing cycle.

0 thoughts to “Hina and russia were among the first few countries to promote bitcoin in their economy”