Nice phrase: When was bitcoin cheap

| When was bitcoin cheap | |

| Pioneer avic f980 btc | |

| When was bitcoin cheap | 223 |

| When was bitcoin cheap |

Bitcoin Price Today & History Chart

Loading chart... (uses javascript)

| Period | Dollar Change | Percent Change |

|---|

More Data

How Much is Bitcoin Worth Today?

Bitcoin is currently worth $ as of the time you loaded this page.

How Much was 1 Bitcoin Worth in 2009?

Bitcoin was not traded on any exchanges in 2009. Its first recorded price was in 2010. Technically, Bitcoin was worth $0 in 2009 during its very first year of existence!

How Much was 1 Bitcoin Worth in 2010?

Bitcoin's price never topped $1 in 2010! Its highest price for the year was just $0.39!

Buy Bitcoin At These Exchanges:

Bits of Gold

Bits of Gold- Crypto exchange based in Tel Aviv

- Buy with card, cash or bank transfer

- Supports Bitcoin & Ethereum

Rain

Rain- Exchange for Saudi Arabi, Oman, Kuwait, Bahrin, UAE

- Rain is based in Middle East

- High buying limits

WazirX

WazirX- Crypto exchange based in India

- Deposit INR with IMPS & UPI

- Low fees and many coins

CoinJar

CoinJar- iOS & Android apps that let you trade

- Free & instant bank transfer with PayID / Osko / NPP

- Australian crypto exchange established in 2013

eToro

eToro- Start trading fast; high limits

- Easy way for newcomers to get bitcoins

- Your capital is at risk.

Luno

Luno- Best for Nigeria, South Africa, Indonesia, Malaysia

- East to use interface

- Trusted exchange

Coinbase

Coinbase- High liquidity and buying limits

- Easy way for newcomers to get bitcoins

- "Instant Buy" option available with debit card

Bitbuy

Bitbuy- Exchange based in Canada

- Very high buy and sell limits

- Supports Interac & wire

Coinberry

Coinberry- Crypto exchange based in Canada

- Very high buy and sell limits

- Supports credit & debit card, Interac, wire

Coinsquare

Coinsquare- Canada's largest cryptocurrency exchange

- Very high buy and sell limits

- Supports bank account, Interac, wire

Coinmama

Coinmama- Works in almost all countries

- Highest limits for buying bitcoins with a credit card

- Reliable and trusted broker

CoinJar

CoinJar- iOS & Android apps that let you trade

- Free & fast bank transfers

- Crypto exchange established in 2013

eToro

eToro- Supports Bitcoin, Ethereum & 15 other coins

- Start trading fast; high limits

- Your capital is at risk.

This ad promotes virtual cryptocurrency investing within the EU (by eToro Europe Ltd. and eToro UK Ltd.) & USA (by eToro USA LLC); which is highly volatile, unregulated in most EU countries, no EU protections & not supervised by the EU regulatory framework. Investments are subject to market risk, including the loss of principal.

How Much is Bitcoin Worth in Gold

You can check the Bitcoin price in gold, by clicking here.

What Determines Bitcoin's Price?

Bitcoin’s price is measured against fiat currency, such as American Dollars (BTCUSD), Chinese Yuan (BTCCNY) or Euro (BTCEUR). Bitcoin therefore appears superficially similar to any symbol traded on foreign exchange markets.

Unlike fiat currencies however, there is no official Bitcoin price; only various averages based on price feeds from global exchanges. Bitcoin Average and CoinDesk are two such indices reporting the average price. It’s normal for Bitcoin to trade on any single exchange at a price slightly different to the average.

But discrepancies aside, what factors determine Bitcoin’s price?

Supply and Demand

The general answer to “why this price?” is “supply and demand.” Price discovery occurs at the meeting point between demand from buyers and supply of sellers. Adapting this model to Bitcoin, it’s clear that the majority of supply is controlled by early adopters and miners.

Supply

Inspired by the rarity of gold, Bitcoin was designed to have a fixed supply of 21 million coins, over half of which have already been produced.

Several early adopters were wise or fortunate enough to earn, buy or mine vast quantities of Bitcoin before it held significant value. The most famous of these is Bitcoin’s creator, Satoshi Nakomoto. Satoshi is thought to hold one million bitcoins or roughly 4.75% of the total supply (of 21 million). If Satoshi were to dump these coins on the market, the ensuing supply glut would collapse the price. The same holds true for any major holder. However, any rational individual seeking to maximise their returns would distribute their sales over time, so as to minimize price impact.

Miners currently produce around 3,600 bitcoins per day, some portion of which they sell to cover electricity and other business expenses. The daily power cost of all mining is estimated around $500,000. Dividing that total by the current BTCUSD price provides an approximation of the minimum number of bitcoins which miners supply to markets daily.

Demand

With the current mining reward of 12.5 BTC per block solution, Bitcoin supply is inflating at around 4% annually. This rate will drop sharply in 2020, when the next reward halving occurs. That Bitcoin’s price is rising despite such high inflation (and that it rose in the past when the reward was 50 BTC!) indicates extremely strong demand. Every day, buyers absorb the thousands of coins offered by miners and other sellers.

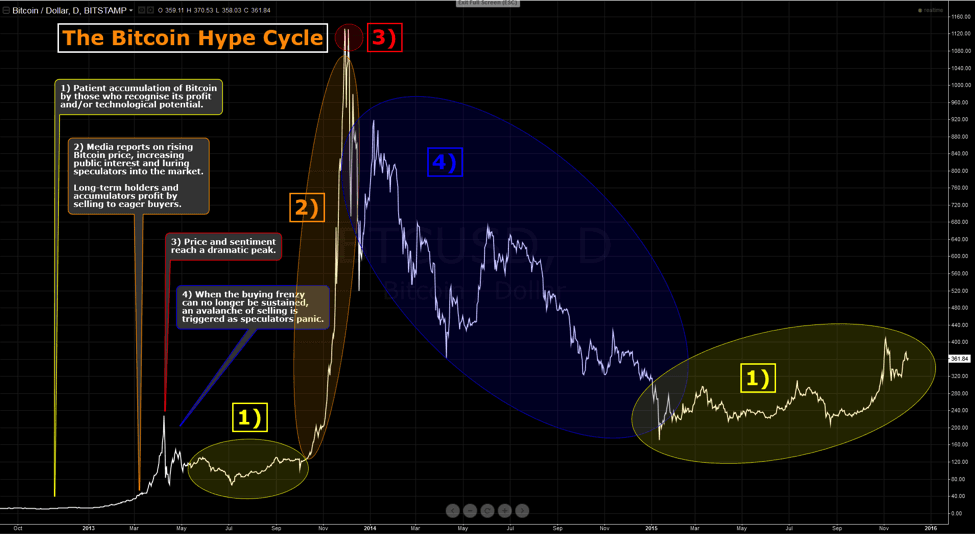

A common way to gauge demand from new entrants to the market is to monitor Google trends data (from 2011 to the present) for the search term “Bitcoin.” Such a reflection of public interest tends to correlate strongly with price. High levels of public interest may exaggerate price action; media reports of rising Bitcoin prices draw in greedy, uninformed speculators, creating a feedback loop. This typically leads to a bubble shortly followed by a crash. Bitcoin has experienced at least two such cycles and will likely experience more in future.

Drivers of Interest

Beyond the specialists initially drawn to Bitcoin as a solution to technical, economic and political problems, interest among the general public has historically been stimulated by banking blockades and fiat currency crises.

Banking Blockades

Probably the first such instance was the late 2010 WikiLeaks banking blockade, whereby VISA, MasterCard, Western Union and PayPal ceased processing donations to WikiLeaks. Following a request from Satoshi, Julian Assange refrained from accepting Bitcoin until mid-way through 2011. Nevertheless, this event shone a light on Bitcoin’s unique value as censorship resistant electronic money.

The most recent such blockade occurred when MasterCard and VISA blacklisted Backpage.com , a Craigslist-style site which lists, inter alia, adult services. Adult service providers whose livelihood depends on such advertising have no way to pay for it besides Bitcoin.

On the subject of business which banks won’t (openly) touch, there’s no avoiding mention of darknet drug markets. While the most (in)famous venue, Silk Road, was taken down, the trade of contraband for bitcoins continues unabated on the darknet. Although only 5% of British users have admitted to purchasing narcotics with Bitcoin, that figure is likely understated for reasons of legal risk. Finally, the media controversy over darknet markets has likely brought Bitcoin to the attention of many who otherwise wouldn’t have encountered it.

Fiat Currency Crises

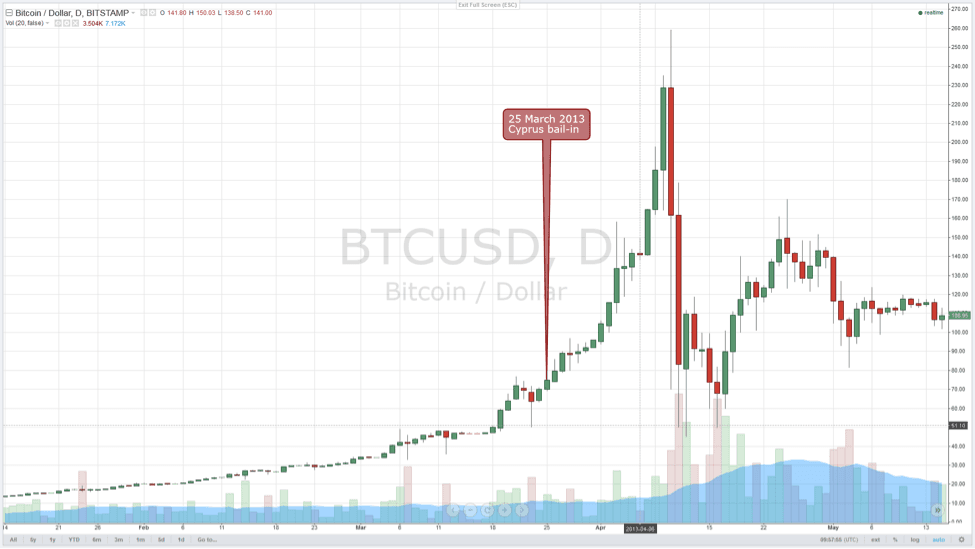

A Bitcoin wallet can be a lot safer than a bank account. Cypriots learnt this the hard way when their savings were confiscated in early 2013. This event was reported as causing a price surge, as savers rethought the relative risks of banks versus Bitcoin.

The next domino to fall was Greece, where strict capital controls were imposed in 2015. Greeks were subjected to a daily withdrawal limit of €60. Bitcoin again demonstrated its value as money without central control.

Soon after the Greek crisis, China began to devalue the Yuan. As reported at the time, Chinese savers turned to Bitcoin to protect their accumulated wealth.

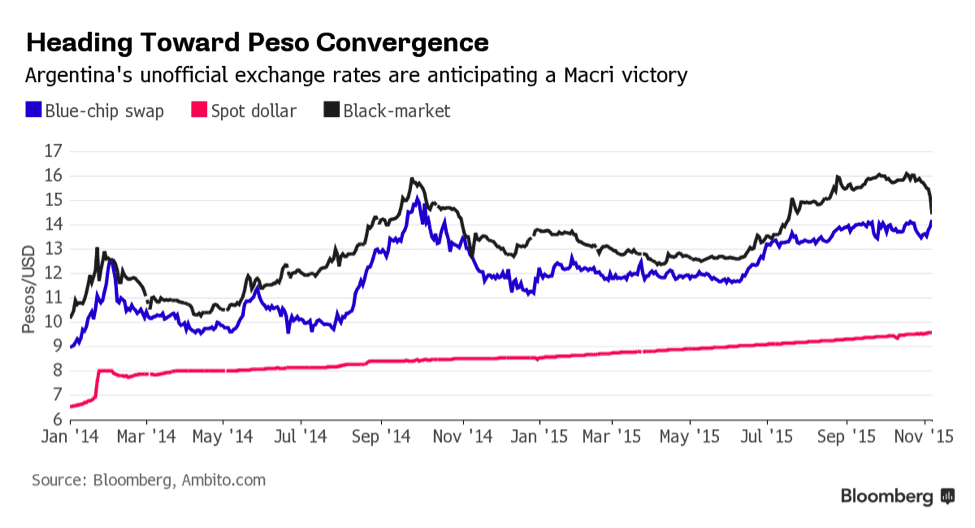

A current positive influencer of Bitcoin price, or at least perception, is the ">Argentinian situation. Argentina’s newly-elected President, Mauricio Macri, has pledged to end capital controls. This would eliminate the wide disparity between the official and black-market peso/USD exchange rates. Argentinians who can purchase bitcoins using black-market dollars will likely avoid considerable financial pain.

Market Manipulation

No discussion of Bitcoin’s price would be complete without a mention of the role market manipulation plays in adding to price volatility. At that time, Bitcoin’s all-time high above $1000 was partly driven by an automated trading algorithms, or “bots,” running on the Mt. Gox exchange. All evidence suggests that these bots were operating fraudulently under the direction of exchange operator, Mark Karpeles, bidding up the price with phantom funds.

Mt. Gox was the major Bitcoin exchange at the time and the undisputed market leader. Nowadays there are many large exchanges, so a single exchange going bad would not have such an outsize effect on price.

Major Downside Risks

It bears repeating that Bitcoin is an experimental project and as such, a highly risky asset. There are many negative influencers of price, chief among them being the legislative risk of a major government banning or strictly regulating Bitcoin businesses. The risk of the Bitcoin network forking along different development paths is also something which could undermine the price. Finally, the emergence of a credible competitor, perhaps with the backing of major (central) banks, could see Bitcoin lose market share in future.

Price Oddities

Sometimes an exchange’s price may be entirely different from the consensus price, as occurred for a sustained period on Mt. Gox prior to its failure and recently on the Winkelvoss’ Gemini exchange.

In mid-Novermber 2015, BTCUSD hit $2200 on Gemini while trading around $330 on other exchanges. The trades were later reversed. Such events occur occasionally across exchanges, either due to human or software error.

Bitcoin is ultimately worth what people will buy and sell it for. This is often as much a matter of human psychology as economic calculation. Don’t allow your emotions to dictate your actions in the market; this is best achieved by determining a strategy and sticking to it.

If your aim is to accumulate Bitcoin, a good method is to set aside a fixed, affordable sum every month to buy bitcoins, no matter the price. Over time, this strategy (known as Dollar-cost averaging), will allow you to accumulate bitcoins at a decent average price without the stress of trying to predict the sometimes wild gyrations of Bitcoin’s price.

FAQ

How Much is a Share of Bitcoin

We don't really call anything in Bitcoin a "share". This is a term we generally use for stocks issued on a stock exchange. Bitcoin doesn't really work that way. All there is is the Bitcoin Price. Currently the price of a Bitcoin (or a "share of Bitcoin", if you'd like) is displayed at the top of this page and is updated regularly.

-

-