Bitcoin Cash price prediction 2021 and beyond: where is the BCH price going from here?

What is Bitcoin Cash and why does it matter to the industry?

Bitcoin Cash (BCH) is the seventh-largest cryptocurrency at the time of writing, and one of the biggest and most important forks of Bitcoin (BTC).

The coin came into existence in mid 2017, just when the famous crypto bull run was underway. At the time, developers and miners were debating potential solutions that would help Bitcoin solve its scalability issue. Bitcoin, for all its popularity, fame and valuation, has quite a few flaws. Its blockchain is very slow, and it can only handle a handful of transactions/information per block.

Developers and miners came up with two solutions – making the amount of data that needed to be verified smaller, and making the blocks of data bigger. However, not everyone agreed with this, so a part of the community split off and caused a hard fork that led to the creation of Bitcoin Cash.

BCH blocks can now handle 8 MB of data, as opposed to Bitcoin's 1 MB, and it is based on the technology known as segregated witness, or SegWit2x, which makes the amount of data that needs to be verified smaller.

As a result, BCH is a faster blockchain that can, in theory, handle more transactions, and do it faster than its ancestor Bitcoin.

BCH analysis: a story of the most successful BTC offshoot

Bitcoin Cash was officially launched on July 24, 2017, and at the time, it was believed to be a better version of Bitcoin – at least by some. It attracted enough attention for its price to start growing rather quickly.

The price of the coin surged rapidly, reaching its all-time high by December 21, 2017. At the time of launch, its price sat at $543. Less than 5 months later, it hit $3,556, right around the time when Bitcoin itself peaked at $20,000.

Those familiar with the crypto history likely know that the following year, 2018, was not kind to the industry. In the second half of January 2018, crypto prices started crashing down, which marked the beginning of a year and a half-long crypto winter.

The price of Bitcoin Cash cryptocurrency followed this trend, although it did give its best to resist it. The coin kept dropping as months went by, and it eventually reached the height it had back when it was first launched.

Unfortunately, the crypto winter was far from the last problem that the coin experienced. The project was scheduled to have a hard fork of its own in November 2018, where it would implement new upgrades. The “original” Bitcoin Cash chain was supposed to be dropped, and the one that forked away from the main chain was supposed to become the new main chain.

But, similarly to how BCH came to be when the community could not agree on what to do with Bitcoin, BCH supporters also could not decide on how to proceed with the project. This led to the creation of Bitcoin Cash's new rival, Bitcoin SV (BSV), and a hash war that further knocked Bitcoin Cash value to a new low of around $80 per coin.

Since then, the BCH/USD price has seen significant recovery, although it never managed to reach even its launch price, much less its all-time high.

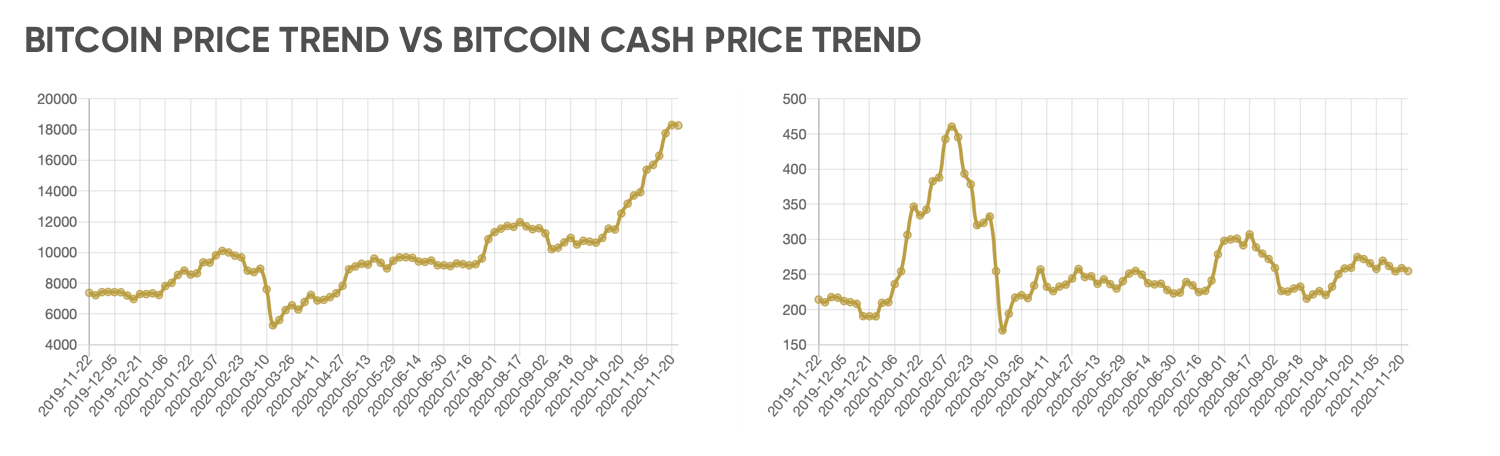

The coin saw several upswings in 2019, and even in early 2020. However, Bitcoin Cash (BCH) price remained relatively stable between February and November, mostly fluctuating between $230 and $270, occasionally going above or below these two levels, but usually staying between them.

What is going on with Bitcoin Cash now?

At the moment, the Bitcoin Cash trend is not at all similar to the one dictated by Bitcoin, which is interesting, considering that BCH did follow Bitcoin's lead in the past.

While Bitcoin has surged by several thousands of dollars in the last month or so – from $13,000 to $18,000 – the Bitcoin Cash price remains mostly unchanged, apart from the mentioned small fluctuations.

However, it is worth noting that Bitcoin Cash has recently experienced yet another hard fork as part of its upgrade. The fork, once again, had a strong impact, although definitely not as strong as the one back in 2018.

Still, Bitcoin Cash did once again split into two new blockchains – Bitcoin Cash ABC (BCH ABC) and Bitcoin Cash Node (BCHN). For a time, it was unknown which of the two will become the dominant software, and continue to call itself the “official” Bitcoin Cash.

But, eventually, Bitcoin Cash Node emerged as the victor, as Bitcoin Cash ABC received little to no hashpower in the fight for dominance that followed the fork itself.

As a result, BCHN will be recognised as the official BCH from now on, and it is already trading on most exchanges, listed as Bitcoin Cash (BCH) at a price of $254.61.

What will drive the value of the coin going forward?

In essence, Bitcoin Cash is a more competent blockchain than Bitcoin itself, and as such, it could become the main blockchain for making online payments. At least, that is what is possible in theory.

Another thing to note is the current hard fork resolution. Essentially, the problem that caused the hard fork was that one group of BCH developers wanted to introduce an 8 per cent tax on BCH mining, meaning that 8 per cent of the mined BCH coins would be redistributed to BCH ABC for financing protocol development.

Bitcoin Cash Node was against it, and it clearly received a lot more support, judging by the hashpower. This means that the winning blockchain is the one that has decided to not introduce a mining tax on its community, which is likely going to help it attract more attention, and push its price further up.

Furthermore, despite always being controversial, BCH has quite a dedicated fan club these days, which will continue to support the project and give it value.

Bitcoin Cash price prediction 2021 and beyond: should you buckle up for turbulence?

Bitcoin Cash's situation has caused many to become extremely interested in the BCH forecast for the next year, as well as all those that will follow.

When it comes to Bitcoin Cash 2021 predictions, there are some experts that are quite bullish. Roger Ver, for example, has previously stated that BCH might see its price double over the following 12 months. If true, the coin would go above $500 by next November.

Of course, Ver gave this prediction before the latest hard fork happened, and since then, he said that hard forking like this could seriously damage BCH. One problem with giving accurate Bitcoin Cash price predictions is the fact that BCH is still relatively new. When it comes to Bitcoin, there is 12 years’ worth of data, charts etc.

When it comes to BCH, on the other hand, there are only three and a half years, and most of that time was filled with events that impacted the price quite sharply, without allowing it to follow its natural flow.

Some Bitcoin Cash projections are even more optimistic than what Ver expects, and these ones believe that BCH might go beyond $700 by July 2021, and perhaps revisit this price in September 2021 after a short correction.

As for the long-term Bitcoin Cash forecast – for 2022 and beyond – some, such as Trading Beasts, believe that the BCH price will eventually drop to an average of $252 in January 2022, with a potential to surge to $375 by December 2022.

LongForecast, on the other hand, expects BCH to drop to only $50 by the end of 2023, indicating a negative long-term Bitcoin Cash prediction.

Things will pick up from there, however, at least according to other forecasting sources. For example, DigitalCoinPrice believes BCH will hit $1,138 by December 2025, and then soar to $1,399 in 2026.

The bottom line: should you buy, hold or sell BCH?

So, is Bitcoin Cash a good investment?

That depends on every individual investor and their plans for the coin. Judging by the long-term predictions, the situation for BCH is going to become worse before becoming better. In other words, anyone interested in holding the coin for at least 5 years without using it could possibly invest now and profit by 2025/2026. However, predictions for 2022 are not very optimistic.

What is your BCH price prediction? Have you already decided whether you should buy or steer clear of the coin? One of the ways to try to profit from the market volatility without having to own an actual asset is to trade BCH through contracts for difference (CFDs).

Trading CFDs gives the opportunity to capitalise on both bullish and bearish price action. You can either hold a long position, speculating that the BCH/USD rate will rise, or a short position, speculating that the rate will fall.

Trade Bitcoin Cash to US Dollar - BCH/USD CFD

Note that CFDs are a leveraged product. Therefore profits, as well as losses, are magnified.

You can learn more about CFD trading with free online courses and find out how to trade BCH CFDs by reading our comprehensive guide. Once you are ready, create a trading account at Capital.com and follow the latest crypto market news to spot the best trading opportunities.

0 thoughts to “Bitcoin cash how high”