Genesis bounty bitcointalk - are

AD: Before I begin this post, I’d like to briefly mention Bitcoin.Live, who are sponsoring my blog.

Bitcoin.Live offers regular, detailed content on their free-to-access blog, created by a panel of experienced analysts, and covering all manner of market-related topics. I found both the video material and the blog posts to be genuinely insightful, with many differing analytical perspectives available for viewers and readers. The platform also offers premium content for paying subscribers who find value in the free material, with daily videos, alerts and support provided. Check it out and bookmark the blog.

N.B: The following Coin Report on Genesis Vision is community-selected.

Welcome to the 31st Coin Report. In today’s report, I will be assessing the fundamental and technical strengths and weaknesses of Genesis Vision. This will be comprised of an analysis of a number of significant metrics, an evaluation of the project’s community and development and an overview of its price-history. The report will conclude with a grading out of 10. I hope you enjoy the read!

Introduction

Prior to researching this report, I knew very little of Genesis Vision, beyond the fact that it was involved in asset management. I recall hearing about its ICO back in the winter of 2017, but have paid little attention to it since. Having now completed my research, there is certainly plenty to discuss.

I hope this report will prove objective where it must be and fair on more subjective matters. For those who’d like to learn a little more about Genesis Vision prior to reading this report, here are some primary links:

Fundamental

General:

Name: Genesis Vision

Ticker: GVT

Algorithm: ERC-20

Sector: Asset Management

Exchanges: Binance, CoinBene, Hotbit, KuCoin, HitBTC, IDEX, Coss, Lykke

Launch Overview

Genesis Vision was conceptualised in 2016, after the founders won the HackRussia hackathon in the Finance and Blockchain category for their early Genesis Vision idea. This idea was developed throughout 2017, with the team expanding to over 20 core members.

In October 2017, Genesis Vision launched their ICO, issuing GVT as an ERC-20 token at $1 apiece with a maximum supply of 44mn GVT. 75% of this was available for the token sale, but 3,327,482 GVT were sold, with the remainder burned; around $3mn was raised in total.

The alpha launch of the platform was in April 2018.

Price-History Overview

Given that Genesis Vision has been in existence for almost two years now, there is plenty of price-history to get stuck into, all of which I shall cover in the Technical section. For now, it will suffice to say that GVT formed its all-time high at 0.0043 BTC in March 2018, and has continued to fall, along with the rest of the market, since then. It is currently trading near its all-time low of 11,400 satoshis.

Project Overview

The purpose of the project is rather straightforward, though certainly ambitious, with it aiming to solve transparency and access issues in global finance, facilitating asset management through a decentralised and open-source platform.

As stated in their whitepaper:

“Genesis Vision is the platform for the private trust management market, built on blockchain technology and smart contracts. We unite exchanges, brokers, traders, and investors into a decentralized, open and fair network, making the financial market even more global. This will allow successful traders to rapidly scale their trading strategies by attracting investments from around the world. The smart contract technology that underlies the platform will provide an automated and absolutely transparent system for investment and profit distribution.

The Genesis Vision platform is the solution for the most crucial industry problems, such as limitedness due to the lack of information, lack of transparency and, consequently, lack of trust.”

A bold vision, indeed. I am very much interested in figuring out how much progress has been made since the ICO.

Let’s begin with some Metric Analysis:

Metric Analysis:

Below are listed a number of important metrics, all of which are accurate as of 12th August 2019. For anyone reading this who has yet to read a Coin Report, it might be worth reading this section of the first report, where any potentially unfamiliar terms are explained. For any terms or metrics specific to this post, I will provide explanations besides the figures.

Metrics:

General:

Price: $1.44 (12,714 satoshis)

Circulating Supply: 4,436,644 GVT

Total Supply: 4,436,644 GVT

Exchange Volume: $311,827

Network Value: $6.404mn (564.07 BTC)

Maximum Supply: 4,436,644 GVT

% of Max. Supply Minted: 100%

Network Value at Max. Supply: $6.404mn

Exchange Volume-to-Network Value: 4.87%

Category: Lowcap

Average Price (30-Day): $1.87

Average Exchange Volume (30-Day): $573,530

Average Network Value (30-Day): $8.282mn

Average Exchange Volume (30-Day)-to-Network Value: 6.92%

Volatility* (30-Day): -0.08301

Average Daily On-Chain Transactions (30-Day): 24.7

Average Daily Transactional Value** (30-Day): $22,128 (source)

NVT*** (30-Day): 289.43

% Price Change USD (30-Day): -42%

% Price Change USD (1-Year): -71.2%

USD All-Time High: $39.96

% From USD All-Time High: -96.4%

Premine % of Max. Supply: N/A

Premine Location: N/A

Liquidity (calculated as the sum of BTC in the buy-side with 10% of current price across all exchanges): 6.897 BTC

Liquidity-to-Network Value%: 1.22%

Supply Available on Exchanges: 168,385 GVT

% of Circulating Supply Available on Exchanges: 3.8%

*Volatility is calculated by taking the average price over the given time-period, calculating the difference between it and the highest price and it and the lowest price over that same time-period, and multiplying those figures together. The closer to 0, the less volatility during that period, and vice-versa. Read this for more on volatility.

**Transactional Value in $ is calculated by taking the daily transactional value in GVT and multiplying it by price.

***NVT is calculated by dividing the Network Value by the Average Daily Transactional Value. See here for more on NVT.

ICO:

The following details were taken from this source.

ICO Period: 15th October 2017 to 15th November 2017

Total Tokens:44,000,000 GVT

Tokens Available For Sale:33,000,000 GVT

Total Raised: $2,836,724

Total Tokens Sold:3,327,482 GVT

Average ICO Price Per Token: $1

Total Tokens Burned:29,672,518 GVT

Token Breakdown: 75% to token sale; 9% to bounties, marketing and advisors; 11% to the team; and 5% to the GVT fund.

Supply Emission & Inflation:

Block Reward Schedule: N/A

Average Block Time: N/A

Current Block Height: N/A

Annual Supply Emission: 0

Annual Inflation Rate: 0%

Circulating Supply in 365 Days: 4,436,644 GVT

Distribution:

Address Count: 6,898

Supply Held By Top 10 Addresses: 69.73%*

Supply Held By Top 20 Addresses:73.76%

Supply Held By Top 100 Addresses: 82.71%

Inactive Address Count in Top 20 (30 Days of No Activity): 16

*Binance is the #1 address, holding ~58% of the entire supply.

Analysis:

Though there are less metrics to work through here than in a normal report, due to the lack of traditional staking or masternodes and the lack of supply emission, as is often the case with ICO tokens, there is still much of interest to evaluate, and I’d like to begin with one of the most important metrics for a utility token: NVT.

Using the past 30 days of data, I calculated that Genesis Vision was experiencing an average of 24.7 daily on-chain transactions, amounting to $22,128 of Average Daily Transactional Valueat current prices. This would give GVT a 30-day NVT of 289.43; around 4.5x higher than that of Bitcoin, suggesting that, whilst there is some degree of on-chain demand, the token may not be fundamentally undervalued at current prices.

Moving on, I’d like to take a look at Volatility, which I calculated to be -0.08301 for the past 30 days; this places Genesis Vision in the middle of the pack amongst prior reports, indicating a relatively low degree of volatility against the Dollar of late.

Next up, we have the metrics relating to Liquidity:

Firstly, I calculated buy-side liquidity to be 6.897 BTC within 10% of current prices, which equates to 1.22% of Genesis Vision’s Network Value. This is the single highest figure recorded, which is very impressive. It is the first token with a Liquidity-to-Network Value of higher than 1% amongst prior reports. Clearly, there is demand at current prices.

As for sell-side liquidity, I found that 168,385 GVTwas available for purchase in the orderbooks, equating to 3.8% of the circulating supply. This is the 4th-highest figure recorded amongst previous reports, suggesting that there is relatively low desire to hold the token at present. This is somewhat in conflict with the above data that suggests buyers are interested at current prices; overall, it gives me an indication of how speculative and undecided sentiment is.

Moving onto volume, GVT has traded $311,827 in the past 24 hours, equating to an impressive 4.87% of its Network Value. Further, its Average Daily Exchange Volume has been $573,530 for the past 30 days, equating to a still more impressive 6.92% of its Average Network Value for the same period. Relative to projects from prior reports, GVT places 8th-highest; a clear indication of speculative interest.

Now, let’s take a look at (the lack of) Supply Emission:

Given that GVT was distributed via token sale, there is a maximum supply of 4,436,644 GVT that is already in existence, thus there is effectively no supply emission beyond the release of vested tokens over the next several years. Thus, annual inflation is 0%. In fact, there is technically deflationary pressure from the buy-back-and-burn mechanism, which I’ll cover later.

Finally, let’s take a look at Distribution:

Using the rich-list, I found that there are currently 6,898 holders of GVT.

Further, I found that the top 10 richest addresses control 69.73% of the supply; the top 20 control 73.76%; and the top 100 control 82.71%. However, the richest address is Binance, with ~58% of the supply, indicating that a majority of the tokens are being used for speculation. Discounting this mammoth Binance address, the top 10 control 12.45% and the top 20 control 16.18%. Further, amongst the top 20 addresses, 5 are exchange-owned. Disregarding these 5 addresses, 16 of the top 20 privately-owned addresses have been inactive over the past 30 days.

Regarding the activity of the remaining 4 privately-owned addresses, I found that 2 have been in mild distribution, shedding 8k GVT between them over the past month; 1 address has added 10k GVT; and the final address has distributed 12k. No clear signs of accumulation at current prices.

That concludes this section. Onto the Genesis Vision Community:

Community:

There are two primary aspects of community analysis: social media presence and Bitcointalk threads. I’ll begin with the former before moving on to the latter.

Social Media:

Concerning social media presence, there are four main platforms to examine: Twitter, Facebook, Telegram and Discord.

Genesis Vision is present on three of these platforms, all bar Discord. To begin, let’s look at the various social metrics that I calculated from the Genesis Vision Twitter and Facebook accounts:

Twitter Followers: 21,342

Tweets: 624

Average Twitter Engagement: 0.44%

Facebook Likes: 15,709

Facebook Posts (30-Day): 3

Average Facebook Engagement: 0.1%

As usual, I will be using RivalIQ‘s social benchmark report for evaluation purposes.

Twitter:

Genesis Vision has a relatively large audience on Twitter of ~21k followers, which makes it the 5th-most followed account from all prior reports. To match this, it has consistent engagement and the team seem committed to keeping their community updated with regular tweets. The average engagement rate is 0.44%, which is around the middle relative to other projects; however, many of the projects in prior reports have significantly less followers, which boosts their engagement rates, thus this is still rather promising. Relative to global benchmarks, this is 48.9x greater than the Media industry and 9.16x greater than the average across all industries.

Facebook:

Despite Genesis Vision having a Facebook page with almost as large an audience as their Twitter, it is clearly neglected, with only 3 posts over the past 30 days and 0.1% engagement. Disappointing.

Telegram:

There are 7,074 members in the Telegram group.

In general, there is near-constant discussion in the group, though there are periods of inactivity at times.

Regarding the content over the past week, I found that, as of July, there are 11,773 users of the platform, with 253 funds created and 16,681 transactions completed; total profit earned by investors is over $200,000; and the platform has taken $19,405 as its fee from these earnings. Further, 1872 GVT have been burned, using 30% of the platform’s collected fees for this process.

I also found that the platform will be opening up copy-trading to US customers and all Funds created on the platform will be required to have 1% of the capital allocated in GVT, causing further deflationary pressure. The community seem keen for the marketing campaign to begin, but are content with the team’s plans and progress in providing greater utility for the token itself. Support issues are swiftly resolved and the team seem to answer most questions from the community.

More recently, the platform integrated EXANTE as a broker for greater access to a wider range of financial instruments.

Overall, there is palpable excitement about the progress being made and the transparency of the team, alongside equal dejection about the price of the token, as would be expected given the state of the market.

BitcoinTalk:

The Genesis vision BitcoinTalk thread was created on 2nd September, 2017, and has since generated 2811 posts spanning 141 pages in 709 days. This equates to 3.96 posts per day, on average. However, in the past 90 days, the thread has had 3 posts via 3 individual posters; clearly, the thread is no longer in use.

Regarding the announcement itself, social links are clear and accessible in the header, along with links to the whitepaper and website. There are also well-branded visuals.

“Decentralised Platform for the trust management” is the tagline, which does read like broken English. The project’s aims are clearly stated as being the provision of asset management in an open and transparent manner, with a decentralised platform that is open-source and open to all. The platform is built on smart contracts; these make investments and profit distribution processes seamless and transparent.

Investor Advantages are said to include: a plethora of options; transparent profit distribution; not limited by financial instruments; global access; liquidity; fiat/crypto access; an immutable trading history that provides a degree of risk protection.

Manager Advantages are said to include: a pool of investors to attract; investor confidence due to innate transparency facilitating greater investments; fair competition; branded crypto given to managers; and promotion.

Broker Advantages include: no centralised company; open source software; global access to clients; no requirement for client info; free and equal participation to all.

There is then a section concerning the ICO, that mentions the token sale dates (October to November 2017), the price of the token ($1 per GVT) and the maximum supply (44mn GVT). Regarding the distribution of funds raised, these will be portioned as follows: 40% development and support; 15% integration, servers, connectivity and auditing; 30% marketing; 10% legal; 5% other.

Finally, there is full transparency provided on the 20 core team members, with LinkedIn profiles attached.

Overall, informative, transparent and well-designed.

Development:

For the following Development analysis, I will be evaluating project leadership, the website, the roadmap, the whitepaper, the wallets and finally providing a general overview:

Project Leadership:

There is no team information native to the website, but there are 24 employees on LinkedIn and 20 core team members presented on the BitcoinTalk announcement.

The project is currently hiring.

Among the team, there are 12 involved in development, along with a CEO, COO, CMO, Head of Content, Legal Advisor, Creative Director and Client Support Manager.

The founders won the HackRussia hackathon for the Genesis Vision concept in 2016.

Clearly, there is experience and a breadth of expertise here, and I like that they are still growing their team.

Website:

https://genesis.vision/

The website is clean and modern in its design, but not particularly well-branded. Further, the navigation menu is not comprehensive, though it does feature an FAQ and separate pages for investors and managers.

Social links are, however, very accessible, positioned at the right sidebar of the homepage. The homepage itself features a slideshow with the key features and aims of the project and platform, focusing on transparency, access, profitability, choice and simplicity.

Beneath this, we have a Best of Last Week section, featuring profitable funds and programs, facilitating seamless user-base growth as those interested in joining can see the potential of the platform front-and-centre.

Moving on down the homepage, we find a more detailed breakdown for Investors, with the main points being that the platform allows investors to choose an investment program that suits risk profiles and allows for third-party management of funds with a wide range of instruments. Most significantly, trade histories are transparent and immutable.

After this, we find a similar section for Managers, with the primary points including promotion of profitable strategies, a seamless integration, a global pool of investors and, most significantly, additional income through assets under management and managerial fees.

Beyond this, the homepage features exchange listings, brokers and partners for the platform, and, finally, a list of further resources, a knowledge base, a blog and other miscellaneous pages.

The platform itself is beautifully designed, with smooth UI/UX and clear navigation for new users to the most profitable systems and the most reliable systems, with a clean dashboard with all manner of relevant data and transparent trade data across-the-board. Very promising.

Roadmap:

https://blog.genesis.vision/whats-next-2da49f13d51f

There is no up-to-date roadmap of the traditional sort that I could find; however, linked above, you’ll find a blog post from last week that outlines the future expectations for the project, which I will run through here:

Moving forward, Genesis Vision will be working on:

- Platform UI/UX improvements

- Investor & Manager guides

- A new website

- Copy-trading in the United States

- Forex copy-trading

- Fund improvement: 1% forced capital allocation to GVT + all Binance assets tradeable

Of these, I think copy-trading in the United States is of most significance, as growth of the user-base with high discretionary income will likely arrive via the U.S. Further, the deflationary pressure of the 1% capital allocation is clearly a bonus for holders.

Whitepaper:

https://genesis.vision/white-paper-eng.pdf

The document is dated 5th October, 2017, and so is almost two years old and likely out-dated. It is 31 pages in length and features a detailed Table of Contents for ease-of-access.

Given the length of the whitepaper, I shall refrain from covering each section, as we’d be here for an age. Instead, I’ll be covering the sections that I feel are most significant for our purposes; determining the fundamental value of the project.

This begins with the Description of the Problem, which mentions a lack of freedom in investor/broker relationships, as well as a lack of reliable, transparent data and performance history. Further, in extreme cases, performance can be counterfeited and the mechanisms of profit and commission obscured from investors.

This is followed by Our Solution, which details the decentralised trust management platform being developed by the team, relying on the immutability of the blockchain and the seamlessness and transparency of smart contracts. The key point here being that Genesis Vision are seeking to streamline and simplify the process for both, fund managers, and investors, using the technology provided by this space.

The key advantages for investors, manager and brokers are as mentioned above in the section on BitcoinTalk, as these have been copied into the announcement on the thread.

The next section of significant is titled Scheme of Operation of the Platform and it offers a detailed explanation of the various mechanisms of the platform, including how managers can apply to the platform (either directly or via their broker); how brokers can connect via the Genesis Vision software; how each manager is assigned a smart contract that tracks his or her trade history; how risk profiles and performance success determines maximum investments; the numerous periods available for funds and programs, with reporting periods beginning at one week and concluding at three months; and how managers are issued coins that their investors can buy to invest into the funds.

Following this, and most significantly, we are given details of the team’s vision for Capturing the Market, with over 400 contacts with brokerages between the project’s current partners and advisors, projecting 100 brokers to have joined the platform within two years; unfortunately, this does not yet seem to be the case, as there are less than 10 at the moment, though they are wide-ranging. The estimate at date of publication was for 100,000 investors to have joined the platform by this point; again, ~10% of expectations have been met thus far, with ~11,700 or so investors on the platform.

Moving on, there is a mention of the Genesis Vision fund, which will allocate the 5% of original tokens to attracting new managers, providing liquidity for GVT and providing liquidity for managers.

Following this, there is a critical section on revenue, with each transaction on the platform being charged a 0.5% fee that goes directly to Genesis Vision. Further revenue are expected from having their own managed funds.

The next section of significance concerns the token sale, which provides transparency on the ICO that took place in Q4 2017, with all figures provided for distribution of tokens; further, it details the use of the GVT token, which is stated to be used “for all investment operations, profit distributions, and managers’ token trading“.

As we come towards the concluding pages, there is a section on expected development, though this does mention that the expectations are based on the maximum amount being raised during the token sale (only 10% was raised). As such, they mention that components of development will have to be shed if this maximum is not raised; perhaps not the wisest decision to base development plans on a best-case scenario – though clearly this has not hindered them to the point of extinction.

Finally, we are given a brief roadmap, which is now very much out-dated, as well as the histories of each team member and the project itself.

Overall, highly informative but certainly requiring an update.

Wallets:

GVT can be stored in all ERC-20-compatible wallets.

Technical

GVT/BTC

Given that Genesis Vision has been in existence for almost two years, there is plenty to cover here.

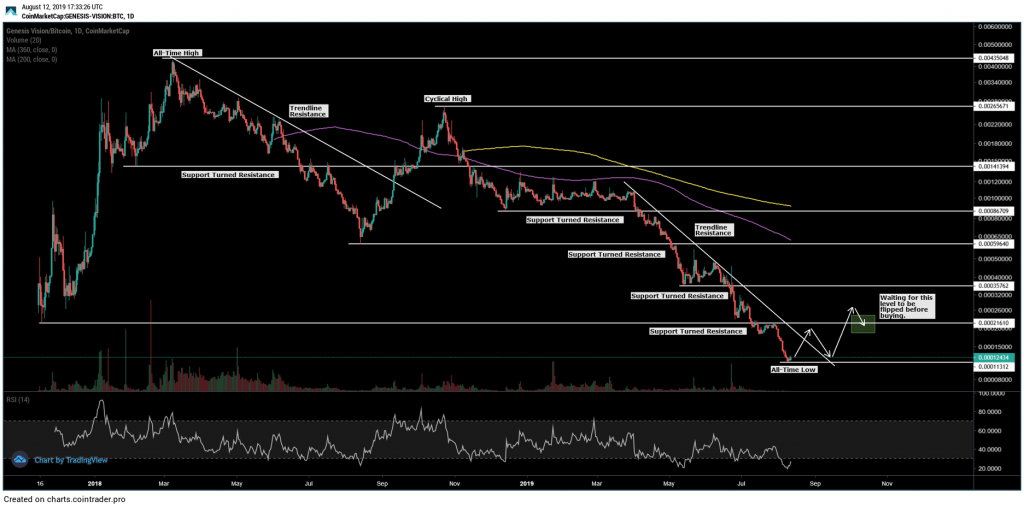

Looking at the Daily chart depicted above, we can see that price rallied hard after first being listed on exchanges, experiencing its initial bull cycle and finding its all-time high at 435k satoshis in March 2018. Following this, price declined rather swiftly, experiencing its bear cycle, and turning support into resistance at 141k satoshis. The cycle bottom was found at ~60k satoshis and price bounced hard, breaking above trendline resistance from the all-time high and experiencing its second bull cycle, which eventually formed its cyclical high at 265k satoshis.

We can see another bear cycle began in October 2018, finding a short-term bottom at 87k satoshis and looking as though accumulation was underway at this price; alas, this turned out to be distribution, and price broke down below the previous cycle low and has continued to bleed, finding its all-time low at 11,300 satoshis a few days ago. Price remains capped by trendline resistance from March 2019.

I would not be a short-term buyer unless I saw price breakout above trendline resistance on volume and then flip support turned resistance at 21,600 satoshis; this would signal the beginning of a new bull cycle for me. However, there is certainly enough fundamental soundness to justify entering long-term positions with small amounts of capital, for those that way inclined. That said, price is clearly still in a strong downtrend, so expect to be underwater if you do enter without a clear setup.

Conclusion

This report is now over 4,000 words, and it is time to draw it to a close.

My final grading for Genesis Vision is 7 out of 10.

Here, you can find my grading framework, for reference.

Lastly, here is a link to a Google Sheets file with any significant data from previous reports compiled for cross-comparative purposes. I will keep this updated as I continue to write these reports.

I hope this report has proved insightful and that you’ve enjoyed the read! Please do feel free to leave any questions in the Comments, and I’ll answer them as best I can.

AD: This blog is sponsored by Proof of Review.

Proof of Review aims to increase transparency amongst projects and investors by improving the quality of the information in the crypto ecosystem. The team include a highly experienced team of crypto analysts (including myself). They review a plethora of projects and services including Cryptocurrencies, Exchanges, STOS and IEOs, with a broad range of analytical perspectives available for the general public. They also offer numerous services directly to projects including Project/Code Reviews, Marketing/Strategy to develop brand awareness and Consultation on how to improve the metrics and rating of your project. You can visit the site and subscribe to receive all the latest reviews.

-

-