Japan bitcoin price - think

Mt. Gox

Mt. Gox was a bitcoin exchange based in Shibuya, Tokyo, Japan.[1] Launched in July , by and into it was handling over 70% of all bitcoin (BTC) transactions worldwide, as the largest bitcoin intermediary and the world's leading bitcoin exchange.[2][3][4][5]

In February , Mt. Gox suspended trading, closed its website and exchange service, and filed for bankruptcy protection from creditors.[6][7] In April , the company began liquidation proceedings.[8]

Mt. Gox announced that approximately , bitcoins belonging to customers and the company were missing and likely stolen, an amount valued at more than $&#;million at the time.[9][10] Although , bitcoins have since been "found", the reasons for the disappearance—theft, fraud, mismanagement, or a combination of these—were initially unclear. New evidence presented in April by Tokyo security company WizSec led them to conclude that "most or all of the missing bitcoins were stolen straight out of the Mt. Gox hot cryptocurrency wallet over time, beginning in late "[11][12]

Founding (–)[edit]

In late , programmer Jed McCaleb thought of building a website for users of the Magic: The Gathering Online fantasy-based card game service, to let them trade "Magic: The Gathering Online" cards like stocks.[13][14][4] In January , he purchased the domain name , short for "Magic: The Gathering Online eXchange".[15][16][17][18] Initially in beta release,[19] sometime around late , the service went live for approximately three months before McCaleb moved on to other projects, having decided it was not worth his time. He reused the domain name in to advertise his card game The Far Wilds.[20]

In July , McCaleb read about bitcoin on Slashdot,[21] and decided that the bitcoin community needed an exchange for trading bitcoin and regular currencies. On 18 July, Mt. Gox launched its exchange and price quoting service deploying it on the spare domain name.[14][22]

Security breach, user DB leak, and invalid addresses ()[edit]

McCaleb sold the site to French developer Mark Karpelès, who was living in Japan, in March , saying "to really make mtgox what it has the potential to be would require more time than I have right now. So I've decided to pass the torch to someone better able to take the site to the next level."[citation needed]

On 13 June , the Mt. Gox bitcoin exchange reported some 25, BTC ($, USD at the time) robbed from accounts. Then on Friday 17 June, Mt. Gox's user database leaked for sale to pastebin, signed by ~cRazIeStinGeR~ and tied to auto@tallerembajador.com.mx.,[23] while the robbing bitcoins from Mt. Gox accounts continued, reportedly, throughout that day.[24] On 19 June, a stream of fradulent trades caused the nominal price of a bitcoin to fraudulently drop to one cent on the Mt. Gox exchange, after a hacker allegedly used credentials from a Mt. Gox auditor's compromised computer to transfer a large number of bitcoins illegally to himself. He used the exchange's software to sell them all nominally, creating a massive "ask" order at any price. Within minutes the price corrected to its correct user-traded value.[25][26][27][28][29][30] Accounts with the equivalent of more than $8,, were affected.[27] To prove that Mt. Gox still had control of the coins, the move of , bitcoins from "cold storage" to a Mt. Gox address was announced beforehand, and executed in Block [31]

In October , about two dozen transactions appeared in the block chain (Block )[32] that sent a total of 2, BTC to invalid addresses. As no private key could ever be assigned to them, these bitcoins were effectively lost. While the standard client would check for such an error and reject the transactions, nodes on the network would not, exposing a weakness in the protocol.

Processor of most of world's bitcoin trades; issues ()[edit]

On 22 February , following the introduction of new anti-money laundering requirements by e-commerce/online payment system company Dwolla, some Dwolla accounts became temporarily restricted. As a result, transactions from Mt. Gox to those accounts were cancelled by Dwolla. The funds never made it back to Mt. Gox accounts. The Mt. Gox help desk issued the following comment: "Please be advised that you are actually not allowed to cancel any withdrawals received from Mt. Gox as we have never had this case before and we are working with Dwolla to locate your returned funds." The funds were finally returned on 3 May, nearly three months later, with a note: "Please be advised never to cancel any Dwolla withdrawals from us again".

In March , the bitcoin transaction log or "blockchain" temporarily forked into two independent logs, with differing rules on how transactions could be accepted. The Mt. Gox bitcoin exchange briefly halted bitcoin deposits. Bitcoin prices briefly dipped by 23%, to $37, as the event occurred,[33][34] before recovering to their previous level (approximately $48) in the following hours.[35]

By April and into the site had grown to the point where it was handling over 70% of the world's bitcoin trades, as the largest bitcoin intermediary and the world's leading bitcoin exchange.[5][4][36][3] With prices increasing rapidly, Mt. Gox suspended trading from 11–12 April for a "market cooldown".[37] The value of a single bitcoin fell to a low of $ after the resumption of trading, before stabilizing above $ Around mid-May , Mt. Gox traded , bitcoins per day, per Bitcoin Charts.[38]

On 2 May CoinLab filed a $75&#;million lawsuit against Mt. Gox, alleging a breach of contract.[39] The companies had formed a partnership in February under which CoinLab was to handle all of Mt. Gox's North American services.[39] CoinLab's lawsuit contended that Mt. Gox failed to allow it to move existing U.S. and Canadian customers from Mt. Gox to CoinLab.[39]

On 15 May the US Department of Homeland Security (DHS) issued a warrant to seize money from Mt. Gox's U.S. subsidiary's account with payment processor Dwolla.[40] The warrant suggested the US Immigration and Customs Enforcement, an investigative branch of the DHS, asserted that the subsidiary, which was not licensed by the US Financial Crimes Enforcement Network (FinCEN), was operating as an unregistered money transmitter in the US.[40] Between May and July the DHS seized more than $5&#;million from the subsidiary.[38][4] On 29 June , Mt. Gox received its money services business (MSB) license from FinCEN.[citation needed]

Mt. Gox suspended withdrawals in US dollars on 20 June [41] The Mizuho Bank branch in Tokyo that handled Mt. Gox transactions pressured Mt. Gox from then on to close its account.[38] On 4 July , Mt. Gox announced that it had "fully resumed" withdrawals, but as of 5 September , few US dollar withdrawals had been successfully completed.[42][43][44]

On 5 August , Mt. Gox announced that it incurred "significant losses" due to crediting deposits which had not fully cleared, and that new deposits would no longer be credited until the funds transfer was fully completed.[45]

Wired Magazine reported in November that customers were experiencing delays of weeks to months in withdrawing cash from their accounts.[36][3] The article said that the company had "effectively been frozen out of the U.S. banking system because of its regulatory problems".

Withdrawals halted; trading suspended; bitcoin missing ()[edit]

Customer complaints about long delays were mounting as of February , with more than 3, posts in a thread about the topic on the Bitcoin Talk online forum.[citation needed]

On 7 February , Mt. Gox halted all bitcoin withdrawals.[46] The company said it was pausing withdrawal requests "to obtain a clear technical view of the currency processes".[46] The company issued a press release on 10 February , stating that the issue was due to transaction malleability: "A bug in the bitcoin software makes it possible for someone to use the bitcoin network to alter transaction details to make it seem like a sending of bitcoins to a bitcoin wallet did not occur when in fact it did occur. Since the transaction appears as if it has not proceeded correctly, the bitcoins may be resent. Mt Gox is working with the bitcoin core development team and others to mitigate this issue."[47][48]

On 17 February , with all Mt. Gox withdrawals still halted and competing exchanges back in full operation, the company published another press release indicating the steps it claimed it was taking to address security issues.[49] In an email interview with the Wall Street Journal, CEO Mark Karpelès refused to comment on increasing concerns among customers about the financial status of the exchange, did not give a definite date on which withdrawals would be resumed, and wrote that the exchange would impose "new daily and monthly limits" on withdrawals if and when they were resumed.[50] A poll of 3, Mt. Gox customers by CoinDesk indicated that 68% of polled customers were still awaiting funds from Mt. Gox. The median waiting time was between one and three months, and 21% of poll respondents had been waiting for three months or more.[51]

On 20 February , with all withdrawals still halted, Mt. Gox issued yet another statement, not giving any date for the resumption of withdrawals.[52] A protest by two bitcoin enthusiasts outside the building that houses the Mt. Gox headquarters in Tokyo continued. Citing "security concerns", Mt. Gox moved its offices to a different location in Shibuya. Bitcoin prices quoted by Mt. Gox dropped to below 20% of the prices on other exchanges, reflecting the market's estimate of the unlikelihood of Mt. Gox paying its customers.[53][54]

On 23 February , Mt. Gox CEO Mark Karpelès resigned from the board of the Bitcoin Foundation.[55] The same day, all posts on its Twitter account were removed.[56]

On 24 February , Mt. Gox suspended all trading, and hours later its website went offline, returning a blank page.[57][58][59] A leaked alleged internal crisis management document claimed that the company was insolvent, after having lost , bitcoins in a theft which went undetected for years.[57][58][60][61]

Six other major bitcoin exchanges released a joint statement distancing themselves from Mt. Gox, shortly before Mt. Gox's website went offline.[62][63]

On 25 February , Mt. Gox reported on its website that a "decision was taken to close all transactions for the time being", citing "recent news reports and the potential repercussions on Mt Gox's operations". Chief executive Mark Karpelès told Reuters that Mt. Gox was "at a turning point".[64][65][66]

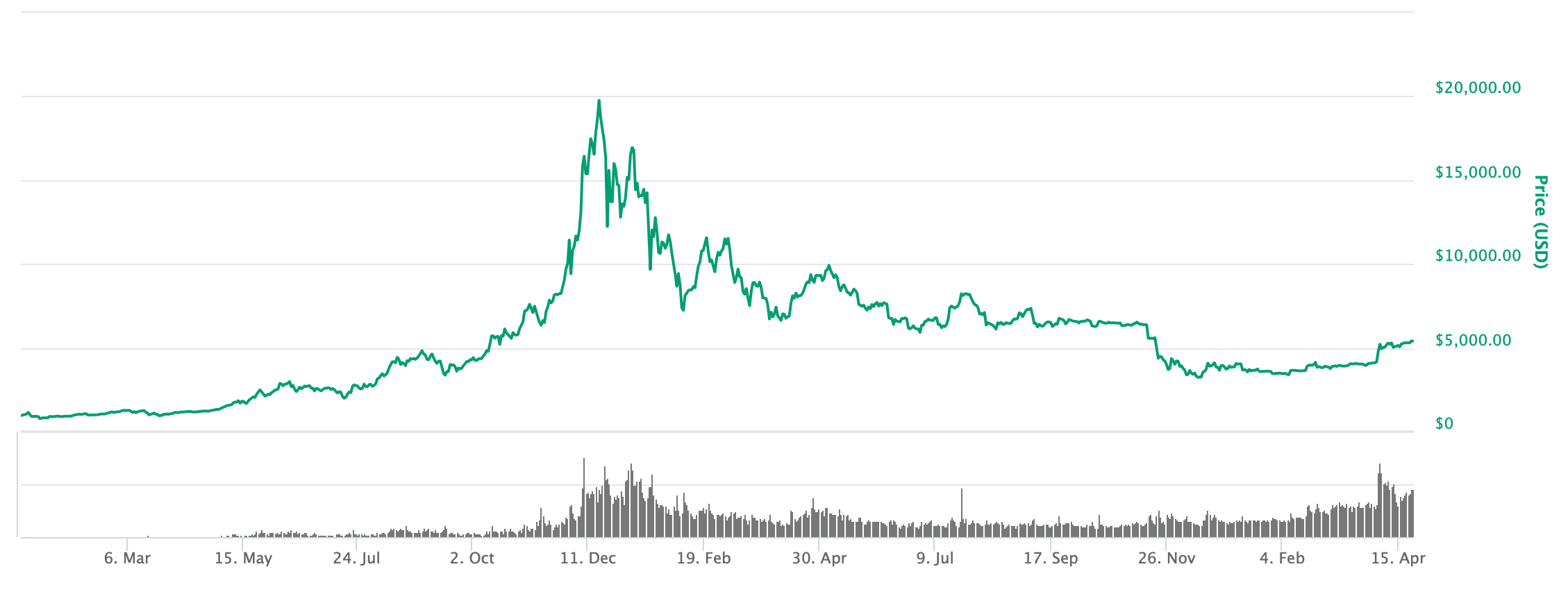

From 1 February until the end of March, during the period of Mt. Gox problems, the value of bitcoin declined by 36%.[67]

The United States Department of Justice identified Alexander Vinnik, owner of the BTC-e bitcoin exchange, as an alleged key figure in the laundering of Mt. Gox's stolen bitcoins.[68]

Bankruptcy; stolen bitcoin (–ongoing)[edit]

On 28 February , Mt. Gox filed in Tokyo for a form of bankruptcy protection from creditors called minji saisei (or civil rehabilitation) to allow courts to seek a buyer, reporting that it had liabilities of about &#;billion yen ($65&#;million, at the time), and &#;billion yen in assets.[6][7][69][70][3]

The company said it had lost almost , of its customers' bitcoins, and around , of its own bitcoins, totaling around 7% of all bitcoins, and worth around $&#;million near the time of the filing.[69][70] Mt. Gox released a statement saying, "The company believes there is a high possibility that the bitcoins were stolen," blamed hackers, and began a search for the missing bitcoins.[10][38] Chief Executive Karpelès said technical issues opened up the way for fraudulent withdrawals.

Mt. Gox also faced lawsuits from its customers.[71]

On 9 March , Mt. Gox filed for bankruptcy protection in the US, to halt U.S. legal action temporarily by traders who alleged the bitcoin exchange operation was a fraud.[72][73][74]

On 20 March , Mt. Gox reported on its website that it found bitcoins—worth around $&#;million—in an old digital wallet used prior to June [citation needed] That brought the total number of bitcoins the firm lost down to ,, from ,[75][non-primary source needed]

New evidence presented in April by Tokyo security company WizSec led them to conclude that "most or all of the missing bitcoins were stolen straight out of the Mt. Gox hot wallet over time, beginning in late "[11][12]

On 14 April, Mt. Gox lawyers said that Karpelès would not appear for a deposition in a Dallas court, or heed a subpoena by FinCEN.[38] On 16 April , Mt. Gox gave up its plan to rebuild under bankruptcy protection, and asked a Tokyo court to allow it to be liquidated.[76]

In a 6 January interview, Kraken bitcoin exchange CEO Jesse Powell discussed being appointed by the bankruptcy trustee to assist in processing claims by the , creditors of Mt. Gox.[77][78][3]

CEO Karpelès was arrested in August by Japanese police and charged with fraud and embezzlement, and manipulating the Mt. Gox computer system to increase the balance in an account—this charge was not related to the missing , bitcoins.[12][79][4][80][81] After he was interrogated, Japanese prosecutors accused him of misappropriating ¥M ($M) in bitcoin deposited into their trading accounts by investors at Mt. Gox, and moving it into an account he controlled, approximately six months before Mt. Gox failed in early [79][82]

By May , creditors of Mt. Gox had claimed they lost $&#;trillion when Mt. Gox went bankrupt, which they asked be paid to them.[12] The Japanese trustee overseeing the bankruptcy said that only $91&#;million in assets had been tracked down to distribute to claimants, despite Mt. Gox having asserted in the weeks before it went bankrupt that it had more than $&#;million in assets.[12] The trustee's interim legal and accounting costs through that date, to be paid ultimately by creditors, were $&#;million.[12]

In March , the trustee Kobayashi said that enough BTC has been sold to cover the claims of creditors.[83]

On 14 March , the Tokyo District Court found Karpeles guilty of falsifying data to inflate Mt. Gox's holdings by $ million, for which he was sentenced to 30 months in prison, suspended for four years, meaning he will serve no time unless he commits additional offenses over the next four years. The Court acquitted Karpeles on a number of other charges, including embezzlement and aggravated breach of trust, based on its belief that Karpeles had acted without ill intent. Nonetheless, the verdict said Karpeles had inflicted "massive harm to the trust of his users" and there was "no excuse" for him to "abuse his status and authority to perform clever criminal acts."[84] Karpeles issued a statement saying he was "happy to be judged not guilty" on the more serious charges and was discussing how to proceed with his lawyers regarding his conviction on the falsifying data charge.[85]

See also[edit]

References[edit]

- ^Ogun, M. N. (8 October ). Terrorist Use of Cyberspace and Cyber Terrorism: New Challenges and Responses. IOS Press. ISBN&#;. Retrieved 9 December &#; via Google Books.

- ^Vigna, Paul (25 February ). "5 things about Mt. Gox's crisis". The Wall Street Journal.

- ^ abcdeFrunza, Marius-Cristian (9 December ). Solving Modern Crime in Financial Markets: Analytics and Case Studies. Academic Press. ISBN&#;. Retrieved 9 December &#; via Google Books.

- ^ abcdeIto, Joi; Howe, Jeff (6 December ). Whiplash: How to Survive Our Faster Future. Grand Central Publishing. ISBN&#;. Retrieved 9 December &#; via Google Books.

- ^ abKutylowski, Miroslaw; Vaidya, Jaideep (15 August ). Computer Security - ESORICS 19th European Symposium on Research in Computer Security, Wroclaw, Poland, September 7–11, Proceedings. Springer. ISBN&#;. Retrieved 9 December &#; via Google Books.

- ^ abMcLannahan, Ben (28 February ). "Bitcoin exchange Mt Gox files for bankruptcy protection". Financial Times.

- ^ abAbrams, Rachel; Goldstein, Matthew; Tabuchi, Hiroko (28 February ). "Erosion of Faith Was Death Knell for Mt. Gox". The New York Times.

- ^"Mt. Gox abandons rebuilding plans and files for liquidation: WSJ". tallerembajador.com.mx. Retrieved 9 December

- ^Abrams, Rachel; Popper, Nathaniel (25 February ). "Trading Site Failure Stirs Ire and Hope for Bitcoin". The New York Times.

- ^ abMt. Gox Seeks Bankruptcy After $ Million Bitcoin Loss, Carter Dougherty and Grace Huang, Bloomberg News, 28 February

- ^ abNilsson, Kim (19 April ). "The missing MtGox bitcoins". Retrieved 10 December

- ^ abcdefPopper, Nathaniel (25 May ). "Mt. Gox Creditors Seek Trillions Where There Are Only Millions". tallerembajador.com.mx. Retrieved 9 December

- ^Marsh, Leslie L.; Li, Hongmei (23 October ). The Middle Class in Emerging Societies: Consumers, Lifestyles and Markets. Routledge. ISBN&#;. Retrieved 9 December &#; via Google Books.

- ^ abStatement by McCaleb February

- ^"Mt. Gox's Original Creator Is At Work On A Secret Bitcoin Project". TechCrunch. AOL. Retrieved 24 February

- ^"5 Things About Mt. Gox's Crisis". WSJ. Retrieved 24 February

- ^"Stripe Backs Non-Profit Decentralized Payment Network Stellar, From Mt. Gox's Original Creator". TechCrunch. AOL. Retrieved 28 April

- ^"Mt. Gox bitcoin exchange closure could help legitimize the currency". Slate Magazine. Retrieved 24 February

- ^"Internet Archive Wayback Machine". tallerembajador.com.mx. Retrieved 24 February

- ^"The Far Wilds: Free Online Strategy Game". Archived from the original on 12 August Retrieved 24 February

- ^"Archived copy". Archived from the original on 7 April Retrieved 5 March CS1 maint: archived copy as title (link)

- ^Sadeghi, Ahmad-Reza (5 August ). Financial Cryptography and Data Security: 17th International Conference, FC , Okinawa, Japan, April 1–5, , Revised Selected Papers. Springer. ISBN&#;. Retrieved 9 December &#; via Google Books.

- ^Bishr Tabbaa (20 June ). "The Mt. Gox Hack— What's in your Bitcoin Wallet?". Medium.

- ^Mark Karpeles (18 June ). "Mt. Gox: If your coins were stolen, please write here". tallerembajador.com.mx Archived from the original on 26 January

- ^Karpeles, Mark (30 June ). "Clarification of Mt Gox Compromised Accounts and Major Bitcoin Sell-Off" (Press release). Tibanne Co. Ltd. Archived from the original on 19 September

- ^Bitcoin Report Volume 8 – (FLASHCRASH). YouTube BitcoinChannel. 19 June

- ^ abMick, Jason (19 June ). "Inside the Mega-Hack of Bitcoin: the Full Story". DailyTech. Archived from the original on 22 April Retrieved 6 April

- ^Lee, Timothy B. (19 June ). "Bitcoin prices plummet on hacked exchange". Ars Technica. Condé Nast.

- ^Mark Karpeles, 20 June , Huge Bitcoin sell off due to a compromised account – rollback, Mt. Gox Support

- ^Chirgwin, Richard (19 June ). "Bitcoin collapses on malicious trade – Mt Gox scrambling to raise the Titanic". The Register.

- ^"Block – Blockchain Block". tallerembajador.com.mx. Retrieved 21 January

- ^"Block – Blockchain Block". tallerembajador.com.mx. Retrieved 21 January

- ^Lee, Timothy. "Major glitch in Bitcoin network sparks sell-off; price temporarily falls 23%". Ars Technica. Condé Nast. Retrieved 12 March

- ^Blagdon, Jeff. "Technical problems cause Bitcoin to plummet from record high, Mt. Gox suspends deposits". The Verge. Retrieved 12 March

- ^"Bitcoin Charts".

- ^ abMcMillan, Robert; Metz, Cade (6 November ). "The rise and fall of the world's largest Bitcoin exchange". Wired. Condé Nast. Retrieved 8 February

- ^"Twitter / MtGox: Trading is suspended until". tallerembajador.com.mx Archived from the original on 13 November Retrieved 17 February

- ^ abcdeMochizuki, Takashi (20 April ). "Tracing a Bitcoin's Exchange's Fall From the Top to Shutdown Mark Karpelès hoped to set up a bitcoin cafe in the building where his exchange rented space". WSJ. Retrieved 22 April

- ^ abcChen, Adrian (2 May ). "Massive Bitcoin Business Partnership Devolves Into $75 Million Lawsuit". Gawker Media. Archived from the original on 13 June Retrieved 8 June

- ^ abDillet, Romain (16 May ). "Feds Seize Assets From Mt. Gox's Dwolla Account, Accuse It Of Violating Money Transfer Regulations". TechCrunch. AOL Inc. Retrieved 10 February

- ^McMillan, Robert (20 June ). "Bitcoin's Big Bank Problem: Why Did Mt. Gox Halt U.S. Payouts?". Wired. Condé Nast.

- ^Vigna, Paul (5 July ). "Bitcoin operator Mt. Gox resumes withdrawals". The Wall Street Journal.

- ^Vigna, Paul (31 July ). "Bitcoin exchange Mt. Gox still grappling with slowdown". The Wall Street Journal.

- ^Marron, Donald (3 September ). "How Bitcoin spreads violate a fundamental economic law". Forbes.

- ^"August Mt. Gox Status Update" (Press release). Mt. Gox Co. Ltd. 5 August Archived from the original on 5 August

- ^ abDougherty, Carter (7 February ). "Bitcoin Price Plunges as Mt. Gox Exchange Halts Activity". Bloomberg. Retrieved 9 February

- ^"Update – Statement Regarding BTC Withdrawal Delays" (Press release). Mt. Gox Co. Ltd. 10 February Archived from the original on 10 February

- ^"mt gox shutdown puts bitcoin investors on edge - tallerembajador.com.mx". tallerembajador.com.mx. Retrieved 24 February

- ^"Announcement: Tokyo, Japan, February 17th, "(PDF) (Press release). Tokyo: Mt. Gox. 17 February Archived from the original(PDF) on 17 February

- ^Mochizuki, Takashi & Warnock, Eleanor (17 February ). "Bitcoin Platform Mt. Gox Apologizes for Delayed Response – CEO Karpeles Declines To Shed Light On How Customer Funds Are Protected". Wall Street Journal.

- ^Wong, Joon Ian (15 February ). "68% of Mt. Gox Users Still Awaiting Their Funds, Survey Reveals". Coin Desk.

- ^Clinch, Matt (20 February ). "Bitcoin investor fury at Mt Gox delays". CNBC.

- ^Byford, Sam (20 February ). "Mt. Gox, where is our money?". The Verge.

- ^"Bitcoin exchange in Downward Spiral: "Mt Gox has left the building"". Hannover, Germany: Heise. 20 February

- ^"Mt. Gox resigns from Bitcoin Foundation". Reuters. 23 February Archived from the original on 29 September Retrieved 25 February

- ^"MtGox Resigns From Bitcoin Foundation, Deletes All Tweets From Twitter Feed". Business Insider. 23 February Retrieved 25 February

- ^ ab

-

-

-